Methanol Weekly Report 3 June 2017

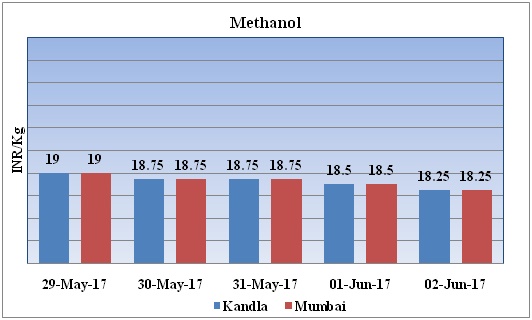

Weekly Price Trend: 29-05-2017 to 02-06-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.18.25/Kg for Kandla and Rs 18.25/kg Mumbai ports.

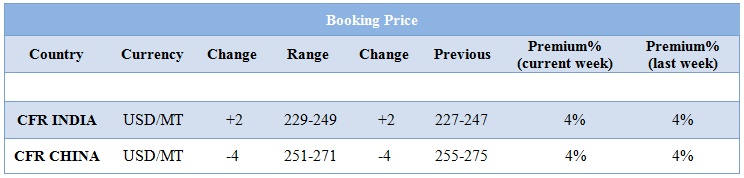

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 18.25/kg for Kandla and Rs 18.25/kg for Mumbai ports.

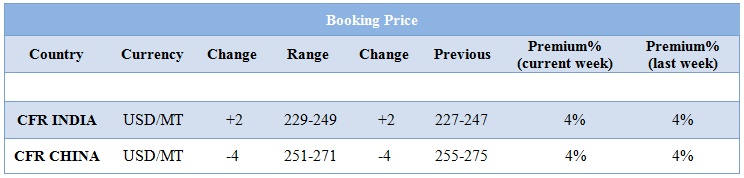

- CFR India prices were assessed in the range of USD 229-249/MTS. Prices have increased by USD 2/mt in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 274/mt.

- CFR China prices were assessed in the range of USD 251-271/MT prices have decreased in compares to previous week.

- As per market players presently material is easily available from china market, whereas demands sentiments has been dreary on account of this domestic methanol prices have plunged.

- Chinese methanol-to-olefins conversion demand has remained weak and this is likely to continue.

- Some market analyst said that volatility existed in methanol market. Methanol imports are expected to rise in Jun and Jul, and domestic plants are resuming production. The industry in China is still oversupplied without enough demand.

- Methanol Prices will likely to remain soft-to-stable in near term on lackluster demand amid ample supply.

- China’s Shandong Yangmei Hengtong runs its MTO plant at 100% capacity.

- N American June methanol contract prices slide with spot decline.

- China's Shaanxi Changqing Energy plans to restart methanol plant.

- This week oil prices have followed volatile trend. After OPEC, Russia and other producers extended their agreement to curb output by 1.8 million barrels a day for another nine months, to force a rebalancing of the oil market, the bearish tone in the oil sector resurfaced.

- As per report, U.S. oil supplies dropped by 6.4 million barrels last week, a positive for the market and a much bigger decline than expected. On Thursday U.S. crude up slightly after a larger-than-expected domestic inventory drawdown.

- On Thursday, closing crude values have increased.WTI on NYME closed at $48.36/bbl, prices have increased by $0.04/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.02/bbl in compared to last trading and was assessed around $50.33/bbl.

- As per market report, U.S. production increased, and the expectation is that ongoing activity in U.S. shale will continue to boost output, offsetting OPEC efforts.

$1 = Rs. 64.44

Import Custom Ex. Rate USD/ INR: 65.35

Export Custom Ex. Rate USD/ INR: 63.70