Methanol Weekly Report 29 Sep 2018

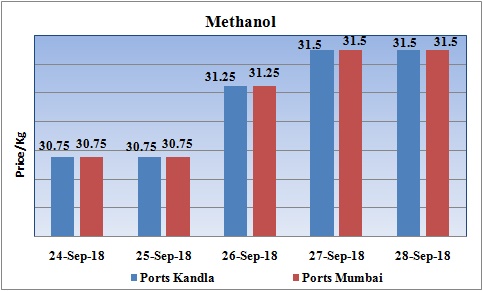

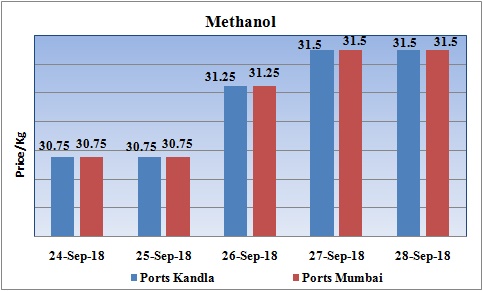

Weekly Price Trend: 24-09-2018 to 28-09-2018

- The above graph focuses on the Methanol price trend for the current week. Prices remained firm for this week in domestic market.

- By the end of the week prices were assessed around Rs 31.5/Kg for Kandla and Mumbai ports.

- There has been rise in domestic values on back of limited supply in domestic market.

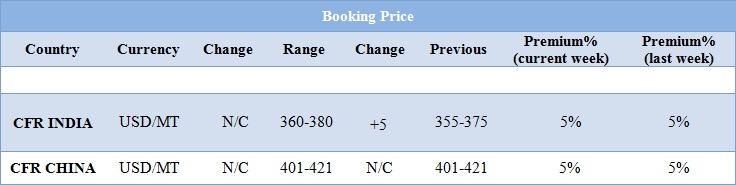

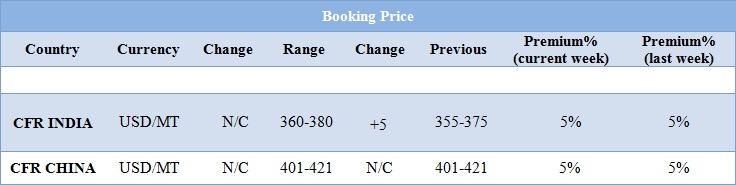

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices remained firm and increased by 0.75 paisa for this week and were assessed at the level of Rs 31.50/kg for Kandla and Mumbai ports.

- CFR India prices were assessed around USD 370/MTS, increased by USD 5/MT for this week. On other side CFR China prices remained unaffected this week and were assessed at USD 411/MT.

- Domestic prices have increased heavily by the month of September. Average prices were in the range of Rs.28-29 in the month of February 2018, which has now reached to the level of Rs.31-32.

- The other major reason for this increase has been the rise in demand in India with arrival of festive season across the nation. Domestic consumption for paint industry increase heavily as people opt for painting and renovation of their properties.

- India is the second largest importer of petroleum products from Iran after China. It includes mainly crude and Methanol. India is trying its ways out to not to stop import of Methanol from Iran. But the scenario is completely uncertain and none of the traders has any answer for what will be the conditions after 4 November 2018.

- In case of China major purchases were avoided in view of upcoming week long vacation. However there has been slowdown in imports of Methanol by China from Iran since last one month. No other country could level up the import levels of China from Iran. The pressure of unsold material will surely affect ran in its production.

- Domestic prices are likely to go down further in next week. With long weekend ahead there will be comparatively slowdown in trading activities. Domestic manufacturer GNFC has reduced its domestic prices for Methanol to Rs. 31.30

PLANT NEWS

Kaltim Methanol Industri’s plans to shut its methanol plant

Kaltim Methanol Industri’s plans to shut its methanol plant for maintenance turnaround in mid-Oct. The plant is based at Kaltim Industri Estate Bontang, Indonesia. It is having the production capacity of 660,000 tonne/year.

METHANEX announced its Asian contract prices and North America prices for the month of October 2018

Canada based Methanex has posted its North American and Asian contract prices for the month of October 2018.

Asian contract prices has been increased by USD 15/MT and were posted at USD 495/MT. Prices posted for the region of North America are USD 496/MT increased by USD 11/MT for this month.

Prices reduced by USD 5/MT for this month. Prices for the Asian Pacific region has also reduced by USD 5/MT for the month of September. The new prices for Asia Pacific region is around USD 480/MT. These prices are valid till 30th September 2018.These prices are valid till 31st October 2018.

$1 = Rs. 72.48

Import Custom Ex. Rate USD/ INR: 73.65

Export Custom Ex. Rate USD/ INR: 71.95