Methanol Weekly Report 29 November 2019

Weekly Price Trend: 25-11-2019 to 29-11--2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.16.25/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 16.25/Kg for Kandla and Mumbai ports, slightly reduced by Rs.0.50/kg for this week.

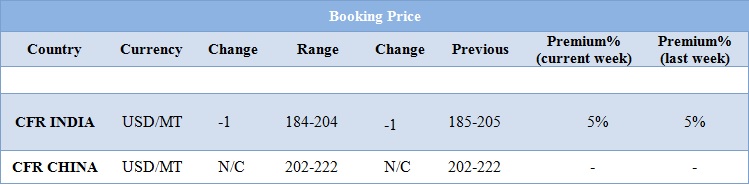

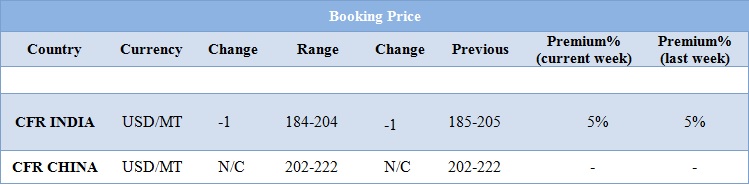

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have reduced very slightly with changes in the domestic market demand. There has been weakening in the demand sentiments in Indian market. Prices in the domestic market reduced slightly for this week and were assessed at the level of Rs.16.25/Kg for bulk quantity.

- CFR India prices were assessed around USD 195/MTS, reduced by USD 7/MT for this week.

- CFR China prices were assessed around USD 202-222/MT reduced by USD 5/MT in values for this week.

- With ongoing winter season in Iran and other major methanol manufacturing nations there will be shortage in the supply of the Methanol as majority of units prefer to undergo maintenance in this duration due to shortage in the supply of natural gas. As it is more used for domestic purpose in this season.

- Crude oil prices on Thursday gained Rs 5 at Rs 4,132 per barrel as speculators created fresh positions amid positive trend in spot market.

- Analysts said rising of bets by participants kept crude prices higher in futures trade.

- On the Multi Commodity Exchange, crude for delivery in December traded higher by Rs 5, 0.12 per cent, to Rs 4,132 per barrel in 25,895 lots.

- Refineries across the United States have reduced their total crude oil processing so far in 2019, as demand for oil products both in America and abroad have weakened.

- There has been slowdown in demand at home and weakening demand abroad, and amid a fuel glut in Asia, refiners in the U.S. have processed lower volumes of crude oil so far this year. The cutting of rates has helped refiners avoid a fuel glut domestically, but lower processing rates have built an oversupply in crude, Kemp notes.

METHANEX announced its Asian contract prices for the month of December 2019

- Canada based Methanex has posted its North American and Asian contract prices for the month of December 2019. Asian contract prices remained unchanged for this week. Prices posted for December were USD 295/MT with no change in these values. Prices posted for North America is USD 342/MT.

$1 = Rs. 71.74

Import Custom Ex. Rate USD/ INR: 72.75

Export Custom Ex. Rate USD/ INR: 71.05