Methanol Weekly Report 29 March 2019

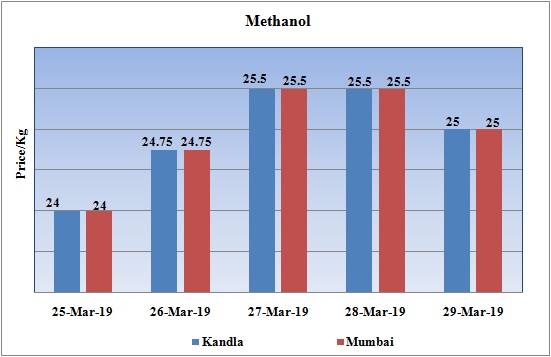

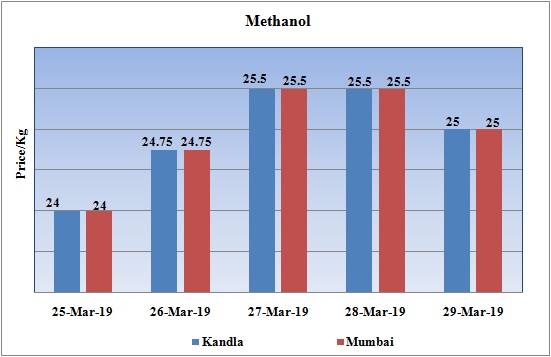

Weekly Price Trend: 25-03-2019 to 29-03-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week. There has slowdown in domestic prices and weakening of values continued throughout this week.

- By the end of the week prices were assessed around Rs 25/Kg for Kandla and Mumbai ports.

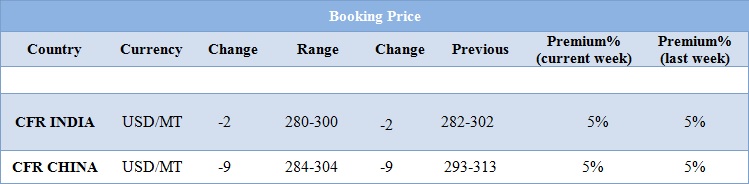

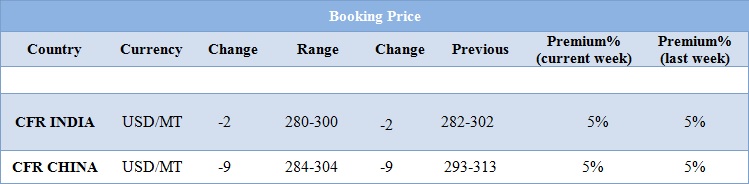

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained highly volatile. Prices in the domestic market slightly improved and were assessed at the level of Rs.25/Kg for this week.

- CFR India prices were assessed around USD 290/MTS, slightly reduced by USD 2/MT in values for this week. On other side CFR China prices also reduced by USD 9/MT and were assessed in the range of USD 284-304/MT.

- There has been decline in pricing for China market since last one week. Earlier the prices were floating at its lowest levels due to weak demand and restart of many units. But many experts still believe that there will be marginal fluctuation in China and South Asian prices in near future.

- Many units based in China are likely to restart their units in upcoming weeks. With this new capacity will be added to the market and supply will get increased.

- Canada based Methanex has posted its North American and Asian contract prices for the month of March 2019. Asian contract prices has been increased USD 10/MT and were posted at USD 370/MT. With upcoming period for maintenance of several major units, the prices are likely to seen and upward trend in Asian market. Prices posted for the Europe remain unchanged for this month and continue to remain USD 360/MT.

- There have been constant fluctuation include prices in international market. US has been worried for the formation of new Middle East bloc comprising of Turkey, Iran and Qatar.

- These nations are already in black list of US, now with strong connection among these countries the trigger is felt by the US government.

- There is one more thing which could derail the oil supplies of US. The quality issue with crude has been a big headache for the manufacturers. Recently two leading Korea importers have cancelled their order for crude from US. Reason behind this declining quality is that there is a massive pipeline network carrying crude oil from the U.S. shale patch to the Gulf Coast ports where it is loaded on tankers and sent to Asia, with South Korea emerging as the biggest buyer of U.S. crude so far this year.

- Yet with so many pipelines—trunks and branches—the oil gets contaminated with various undesirable things, from oil residue to heavy metals, pipe cleaning agents, and a group of compounds called oxygenates. These last ones are particularly worrying for refiners, it seems.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $59.30/bbl. Prices have decreased by $0.11/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.01/bbl in compare to last closing price and was assessed around $67.82/bbl.

PLANT NEWS

Methanol unit to be restarted by Qinghai Guilu Chemical

- Qinghai Guilu Chemical will restart its Methanol unit after long maintenance haul. Earlier the unit was shut down in the month of October last year. Now the company has announced its restart date and will restart the production on 30th March.

- Unit is based at Xi'ning, Qinghai province of China and has the manufacturing capacity of 8,00,000 mt/year.

Methanol unit shut down by Shaanxi Yulin NG Chemical

- Shaanxi Yulin Natural Gas Chemical has shut down its Methanol unit for annual maintenance. The unit was shut down on 25th March and is expected to remain off-stream for around two weeks.The unit is likely to resume its production on 8th April 2019.

- Unit is based at Yulin in Shaanxi province of China and has the production capacity of 6,00,000 tonnes/year.

$1 = Rs. 69.21

Import Custom Ex. Rate USD/ INR: 70.00

Export Custom Ex. Rate USD/ INR: 68.35