Methanol Weekly Report 29 July 2017

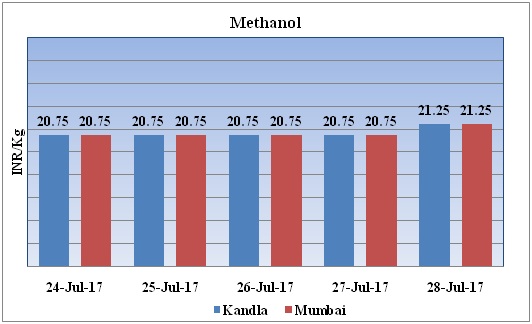

Weekly Price Trend: 24-07-2017 to 28-07-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed up inclination for this week. By the end of the week prices were assessed around Rs.21.25/Kg for Kandla and Rs 21.25/kg Mumbai ports.

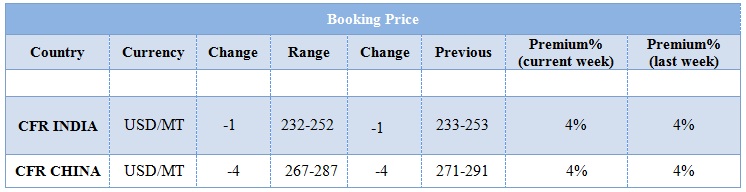

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up inclination and by the end of the week prices were evaluated at Rs 21.25/kg for Kandla and Rs 21.25/kg for Mumbai ports.

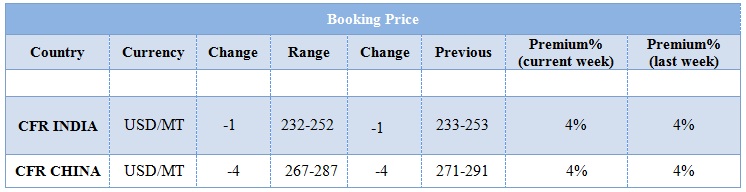

- CFR India prices were assessed in the range of USD 232-252/MTS. Prices have decreased in compares to previous week.

- This week in China market prices have plunged CFR China prices were assessed in the range of USD 277/mt.

- Presently methanol market is moving with uncertain velocity.

- Canada based Methanex has announced its ACPC for the month of October. The prices has been unchanged for the month August. Asian Contract prices are posted at USD 320/MTS.

- Prices posted for the region of Europe around USD 320/MT.

- Canada Methanex misses Q2 estimates despite income swing.

- In domestic market on account of heavy monsoon condition demand sentiments have been bearish no major deals and discussion have been heard.

- In china market material is available in ample amount but stipulation from end users has been bearish.

- This week oil prices have followed up trend. On Thursday oil prices have boosted 8 weeks high on a hope that a steeper-than-expected decline in U.S. crude oil inventories will reduce global oversupply.

- On Thursday, closing crude values have increased.WTI on NYME closed at $49.04/bbl, prices have increased by $0.29/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.52/bbl in compared to last trading and was assessed around $51.49/bbl.

- As per report, U.S. crude stocks fell sharply last week as refineries increased output and imports declined, while gasoline stocks decreased and distillate inventories fell.

- Some players said that expectations that the long-oversupplied market is moving towards balance were also supported news that Saudi Arabia plans to limit crude exports to 6.6 million barrels per day (bpd) in August, about 1 million bpd below the level last year.

- Some producers announced plans to cut spending this year as a result of low oil prices. But analysts say oil prices may have little room to head higher as recent gains could encourage more output, particularly from U.S. shale producers with low costs.The market will likely be paying even more attention to drilling activity in the U.S. in the coming weeks.s

$1 = Rs. 64.16

Import Custom Ex. Rate USD/ INR: 65.20

Export Custom Ex. Rate USD/ INR: 63.50