Methanol Weekly Report 26 July 2019

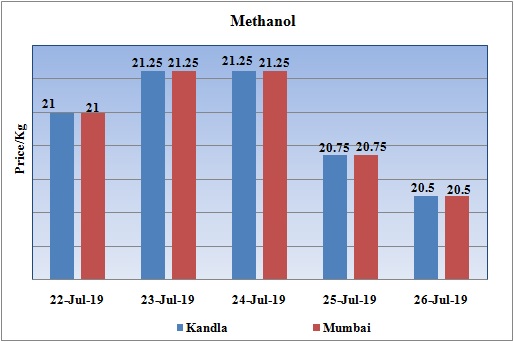

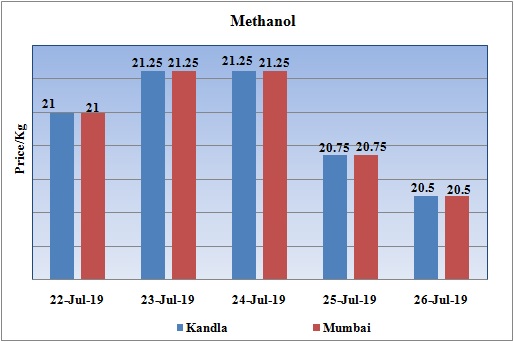

Weekly Price Trend: 22-07-2019 to 26-07-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.20.55/Kg for bulk quantity by end of the week. Prices reduced significantly by Rs.0.50/Kg for this week.

- By the end of the week prices were assessed around Rs 20.5/Kg for Kandla and Mumbai ports.

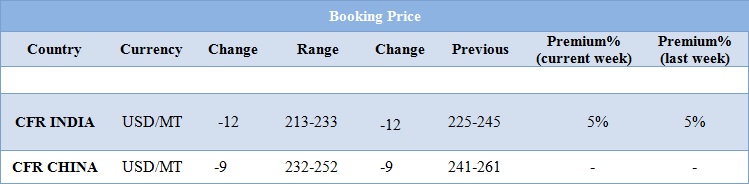

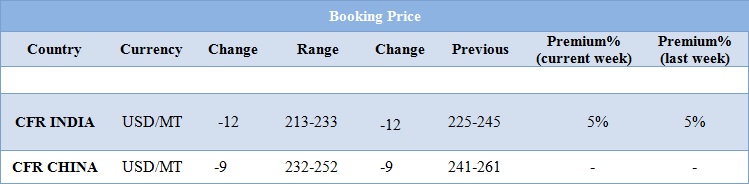

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market reduced significantly for this week and were assessed at the level of Rs.20.5/Kg for bulk quantity.

- CFR India prices were assessed around USD 223/MTS, reduced by USD 12/MT for this week. With ongoing monsoon season at its peak there has been significant decline in demand for Methanol. There has been slowdown in demand from domestic market due to monsoon across the nation.

- CFR China prices were assessed around USD 231-252/MT, reduced by USD 9/MT for this week.

- Benzene the major source for aromatic products has reduced for this week. FOB Korea values for Benzene were assessed around USD655/MT, reduced by USD20/MT for this week, while CFR China prices also increased and were assessed at the level of USD 655/MT for this week.

- OPEC is considering using several metrics to assess where global oil (over)supply stands, including taking the five-year average of oil stocks in 2010-2014 instead of the most recent five-year average 2014-2018, which it currently reports in its monthly oil market reports and which the International Energy Agency (IEA) also takes as a benchmark to measure oil inventories.

- OPEC and its Russia-led non-OPEC allies are in their third year of managing supply to the market, hoping to draw down high inventories and push up oil prices.

- With demand rising over the next nine months and the commitments from all the countries, including the Kingdom of Saudi Arabia, we are approaching the normal levels of supplies of 2010-2014. It is one of the options in front of us as a goal.”

- The rate of the last five years is another option, which we think is unsuitable. We will study the middle options between these two choices. In any case, we will make sure that the market is balanced with proportionate indicators.

$1 = Rs. 68.92

Import Custom Ex. Rate USD/ INR: 69.65

Export Custom Ex. Rate USD/ INR: 67.95