Methanol Weekly Report 25 March 2017

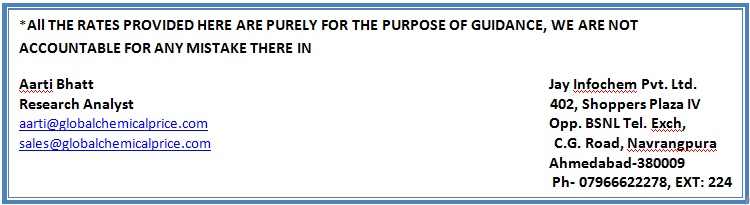

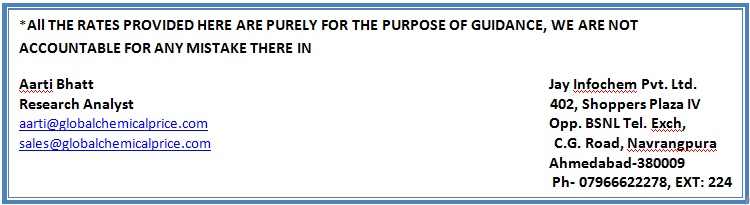

Weekly Price Trend: 20-03-2017 to 24-03-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.25.75/Kg for Kandla and Rs 25.25/kg Mumbai ports.

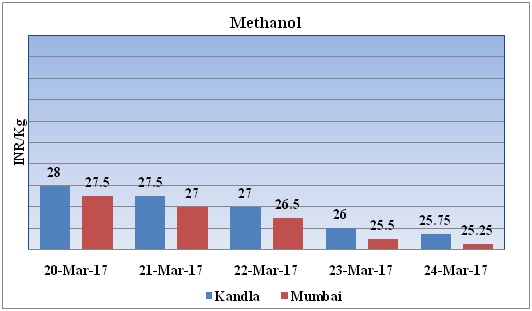

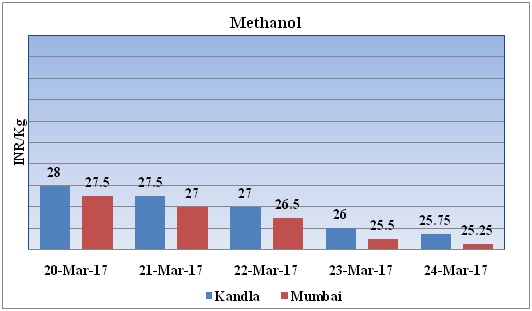

Total import at various ports of India February, 2017

Above chart represent the imported quantity of Methanol for the month of February, 2017. Previous month total imported quantity was around 149851mt. As per the chart last month at Vizag port lower quantity has been imported while at Kandla port imports was higher.

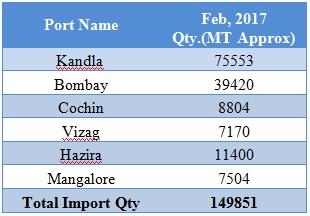

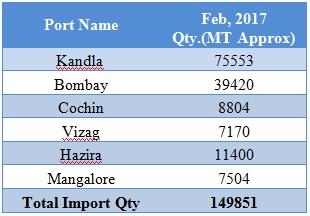

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 25.75/kg for Kandla and Rs 25.25/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 305-325/MTS. Prices have plunged in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 366/mt.

- CFR China prices were assessed in the range of USD 296-316/MT prices have decreased in compares to previous week.

- Recently methanol market is moving with downward velocity market players have been uncertain for upcoming market outlook.

- In last fifteen days domestic methanol prices sharply have plunged. Some market players have said that supply is higher in compare to demand on account of this prices have fallen drastically.

- East China methanol market has faced extended downward.

- Methanol plant operated by Yigao Sanwei is undergo maintenance in the second half of March 2017. Unit is likely to remain off-stream for around two weeks. China based unit has the production capacity of 3,00,000 mt/year.

- As per report, China methanol discussions remained firmer in the midst of rebounding futures.

- This week oil prices have followed scrawny inclination. Oil prices have plunged as U.S. crude inventories rising faster than expected, piling pressure on OPEC to extend output cuts beyond June. Now investors await a meeting between OPEC and its allies that may signal whether they will extend output curbs.

- As per source American crude output continued to rise along with inventories, While OPEC won’t formally decide until May whether to extend production curbs, officials will meet this weekend in Kuwait to discuss their deal’s progress.

- Market analyst said that without the production cut agreement, prices could basically target the low-to-mid $30s, players are positive that they will extend production cut. Some players are anticipating lowering prices due to high supplies.

- On Monday WTI were closed at $49.31 and Brent closed at $51.76 while on Thursday, closing crude values have decreased.WTI on NYME closed at $47.70/bbl, prices have decreased by $0.34/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.08/bbl in compared to last trading and was assessed around $50.56/bbl.

$1 = Rs. 65.41

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50