Methanol Weekly Report 25 Jan 2019

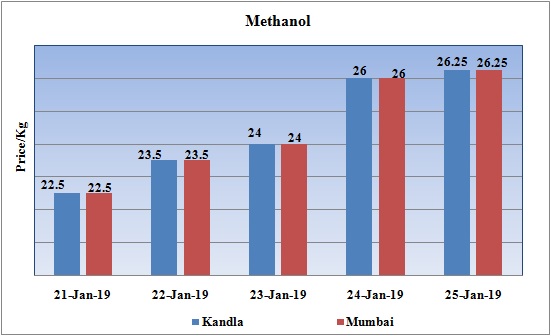

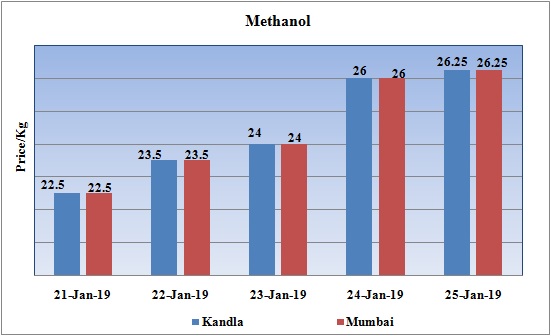

Weekly Price Trend: 21-01-2019 to 25-01-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week. There has been firmness in the values for this week.

- By the end of the week prices were assessed around Rs 26.25/Kg for Kandla and Mumbai ports. Prices increased by Rs.3.75/Kg for this week.

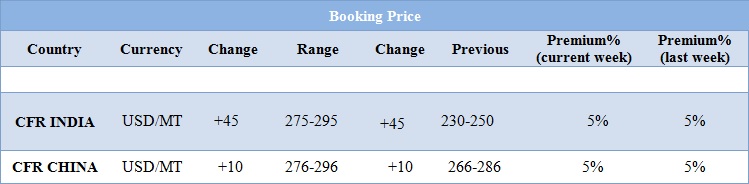

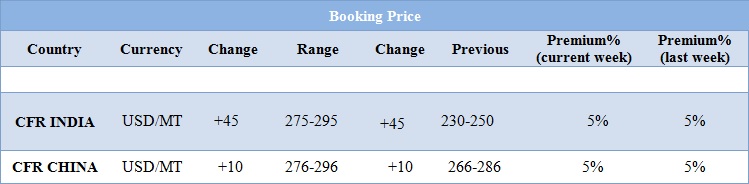

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices have improved significantly on back of firmness in the international market. The abundant supply has now become limited and demand has surged in domestic market.

- Prices in the domestic market increased and were assessed to the level of Rs.26.25/Kg for bulk quantity.

- CFR India prices were assessed around USD 286/MTS, heavily increased by USD 45.5/MT for this week. On other sideCFR China prices increased by USD 10/MT for this week and were assessed at the rate of USD 286/MT.

- After weeks of downfall this has been one significant hike in last two months in Methanol prices for Indian market. The market sentiments are under great pressure and prices may soar up in upcoming weeks. The immediate impact will be seen on Monday as there will be holidays on back of Independence day.

- Crude has been on toes as US/China continues to worry the world and on other side there has been heavy production of crude from US.

- These global worries are having an adverse impact on the world economic growth. On Thursday, closing crude values have increased. WTI on NYME closed at $53.13/bbl. Prices have increased by $0.51/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.05/bbl in compare to last closing price and was assessed around $61.09/bbl.

- Qatar Fuel Additives Co has announced its turnaround schedule for its Methanol unit. The unit will go off-stream on 22nd February 2019 and is likely to remain for around two weeks. The unit will resume its production on 7th April 2019. Unit is based at Messieed in Qatar and has the production capacity of 1,100,0000 tonnes/year.

- Europe based Equinor has restarted its Methanol plant after brief maintenance. It is one of the largest methanol plant in Europe. Earlier the unit was shut down in the month of December on back of fire issue and was now restarted last week. Equinor’s plant has the production capacity of 900,000 tonnes/year and is based at Tjeldbergoddezn, Norway

- The effect of such a shutdown would have been very different if the timing was earlier in 2018, for example the summer when concerns about possible delayed material from Russia due to World Cup-related transport restrictions helped push up values.

$1 = Rs. 71.16

Import Custom Ex. Rate USD/ INR: 72.10

Export Custom Ex. Rate USD/ INR: 70.40