Methanol Weekly Report 24 Nov 2018

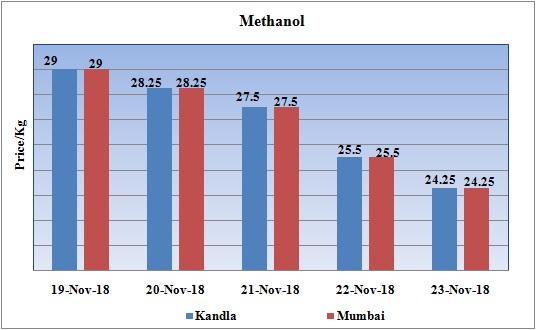

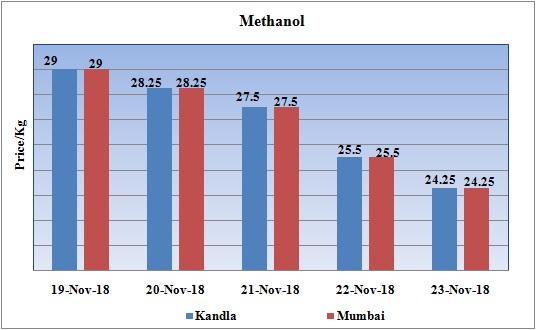

Weekly Price Trend: 19-11-2018 to 23-11-2018

·The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week.

·By the end of the week prices were assessed around Rs 24.25/Kg for Kandla and Mumbai ports.

·Domestic prices have reduced by Rs.4.75/Kg for bulk quantity in the span of one week. Decline has been due to oversupply of chemical in the domestic market.

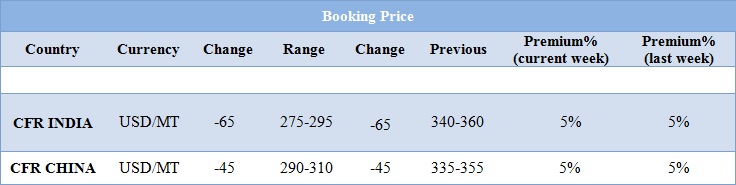

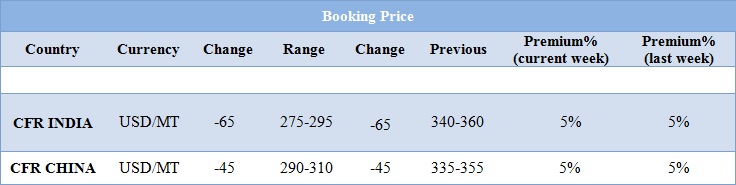

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices declined significantly on back of oversupply of chemical in the international market. By end of the week prices were assessed around Rs.36.25/Kg for Kandla and Mumbai port for bulk quantity.

- CFR India prices were assessed around USD 285/MTS, reduced by USD 65/MT for this week. On other side CFR China prices were assessed around USD 300/MT reduced by USD 45/MT for this week.

- Post Diwali market has remained vulnerable with constant fluctuating international prices. Crude market has declined by more than 30% in the month of November. Prices have remained vulnerable throughout this week.

- In last one month, crude prices have reached to its lowest level with WTI closed at $54.43 which was earlier $75 per barrel in the first week of October. Decline in crude values has also affected the Indian currency against dollar. Rupee settled at Ra.70.6 reduced by Rs.5 against dollar.

- Decline in crude values has affected petrochemical market heavily. Before Iran sanctions the market was on great high with fear of decline in crude supply. Crude supply from Saudi was also reduced internationally to built up the crude values. As a result most of the crude from Iran was dumped into the China market.

- China market is also facing heavy decline in Methanol values. Although many units which are based on natural gas has reduced their operations due to deficit in supply of natural gas which is now directed towards the domestic purpose. Major MTO plants in China has also shut down their production on back of bulk supply.

- Shortage in the availability of natural gas will put a halt on the operation of many natural gas fed methanol plant. The other units which are based on coke have already curtailed their production due to government’s strict policy on pollution control. With starting of last quarter for 2018, many plants have now reduced their operating rates. In Sinchuan and Chongqing most of units are now operating at 70% rate capacity. Qinghai’s Guilu and Qinghai Zhonghao’s Methanol plants with production capacities of 800 Kt/year and 600Kt/year have already been shut down and the other major groups has also reduced their production.

- Methanol prices in domestic market have reduced by 300 Yuan at ZCE Exchange in one week. There are many units based in China which has either shut down their production or will soon opt for plant maintenance.

PLANT NEWS

Methanol plant shut down by Guilu Chemical

China based Guilu Chemical has shut down its Methanol unit for maintenance turnaround. The unit has the production capacity of 800 Kt/year and is based at Qinghai province of China. The unit has been shut down due to shortage in the supply of natural gas. Last year this unit was shut down in the month of November on contrary this year the unit was shut down in the month of October itself.

Methanol unit to be shut down by Chongqing Carbinol

Chongqing Carbinol is planning to shut down its Methanol unit for maintenance turnaround. The unit has the production capacity of 850 Kt/year and is based at Chongqing province of China. The unit has already curtained its production rate and will go off-stream in December end.

Methanol unit shut down by Qinghai Zhonghao

Qinghai Zhonghao has shut down its Methanol unit for maintenance turnaround. The unit has the production capacity of 600 Kt/year and is based at Qinghai province of China. The unit was shut down in the first week of November due to limited supply of natural gas.

$1 = Rs. 70.67

Import Custom Ex. Rate USD/ INR: 72.95

Export Custom Ex. Rate USD/ INR: 71.25