Methanol Weekly Report 23 Dec 2017

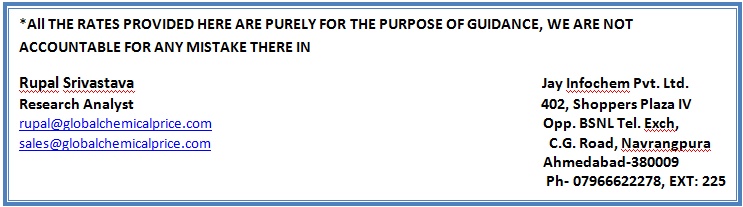

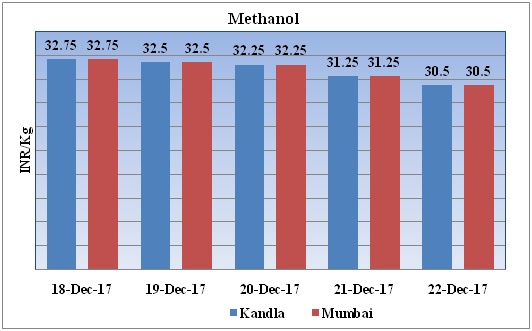

Weekly Price Trend: 18-12-2017 to 22-12-2017

The above graph focuses on the Methanol price trend for the current week. Prices have decreased for this week. By the end of the week prices were assessed around Rs 30.5/Kg for Kandla and Rs 30.5/kg Mumbai ports.

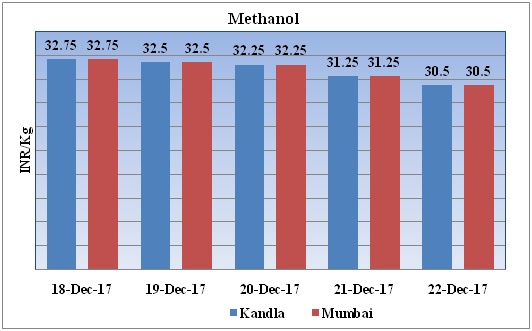

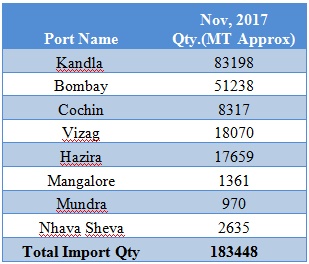

Total import at various ports of India November, 2017

Above chart shows the total imported quantity of Methanol for the month of November 2017. Previous month total imported quantity was 183448MT. As per chart last month at Kandla port imports were higher while at Mundra port imported quantity was lesser.

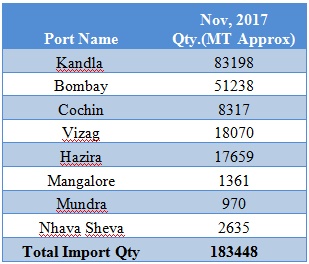

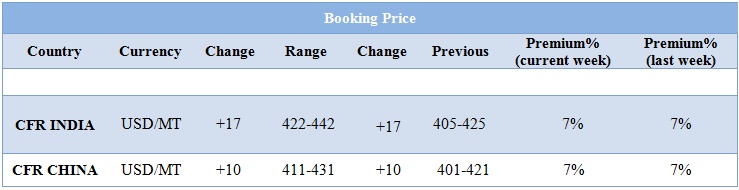

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak trend and by the end of the week prices were evaluated at Rs 30.5/kg for Kandla and Rs 30.5/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 422-442/MTS. Prices have increased by USD 17/mt in compares to previous week.

- CFR South East Asia prices of methanol were evaluated at the USD 425/mt.

- This week domestic methanol prices have plunged on upcoming festive holiday in China.

- Methanol prices are moving up with very fast velocity in Asia on shortage of supply.

- In domestic market methanol prices have escalated to Rs 33.5/kg as of 18th Dec. In China market methanol prices also have increased on limited availability of material.

- Market players have said that methanol supply stiffed as several methanol plants in Asia are shut or remain closed. China Shipments decreased and inventory in East China runs low.

- In China market, feedstock natural gas availability is firm as some regions are changing from coal to electricity or natural gas for heating. Some natural gas-based methanol plants in Southwest are closed. Demand for methanol in fuel application enlarges and domestic product inventory is decreasing.

- As per market analyst, the heightened shortage of supply will remain same in near term as demand is increasing for feedstock methanol from fuel and other industry users and cargo in East China will remain tight. Moreover, some domestic methanol-to-olefins plants cut operating rates or shut down but do not affect cargo availability much.

- The Niti-Ayog of central government is considering a proposal for suggesting the creation of a Methanol Economy Fund with a corpus of ₹4000-₹5000 crore.

- Under the roadmap, the Aayog proposes ramping up facilities to convert Coal, Stranded Gas and Biomass to Methanol. Saraswat said, “The current installed capacity of Methanol production of the country is 0.47 million tonne and the total production of the Methanol in the country is 0.2 million tonne. But the total Methanol consumption of the country in 2016 is 1.8 million tone. The country will need to develop a Methanol manufacturing capacity of around 3 to 4 million tonne to meet the expected demand, as per market players.

- Kaltim Methanol Industri has restarted its Methanol unit post brief maintenance period. Earlier the unit was shut down in the last week of November as per annual maintenance schedule in winter season. Unit is based at Bontang in Indonesia and has the manufacturing capacity of 6,60,000 mt/year.

- This week oil prices have followed mixed trend and closed on higher note. On Thursday, Oil prices higher, erasing earlier losses as Britain's Forties pipeline in the North Sea was expected to restart in early January after repairs over Christmas. Forties is the largest of the five North Sea crudes that underpin Brent, a benchmark for oil trading in Europe, the Middle East, Africa and Asia.

- On Thursday, closing crude values have increased. WTI on NYME closed at $58.36/bbl; prices have increased by $0.27/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.34/bbl in compared to last trading and was assessed around $64.90/bbl.

$1 = Rs. 64.04

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.20