Methanol Weekly Report 23 August 2019

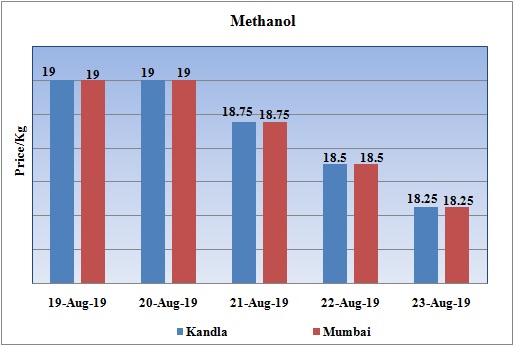

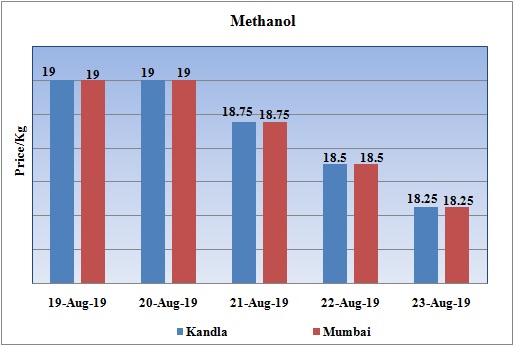

Weekly Price Trend: 12-08-2019 to 16-08-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.18.25/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 18.25/Kg for Kandla and Mumbai ports.

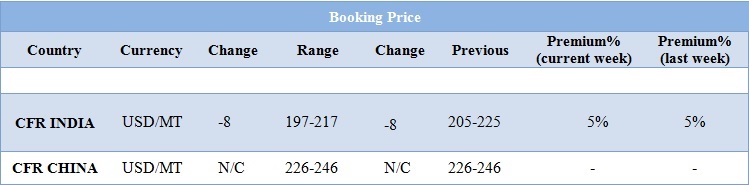

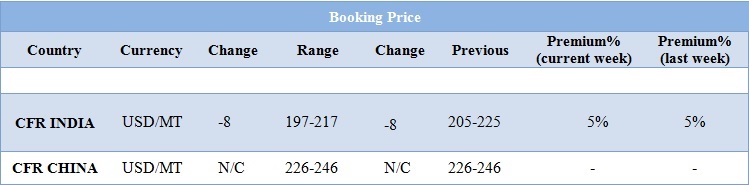

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market reduced significantly for this week and were assessed at the level of Rs.18.25/Kg for bulk quantity.

- CFR India prices were assessed around USD 207/MTS, reduced by USD 8/MT for this week. With ongoing monsoon season at its peak there has been significant decline in demand for Methanol. There has been slowdown in demand from domestic market due to monsoon across the nation.

- Indian market is operating at slow note due to ongoing festive season across the nation.

- CFR China prices were assessed around USD 226-246/MT, with no change in values in compare to last week’s closing values for this week.

- There has been major slump in Methanol prices in China market. The crucial factors have been demand and supply fundamentals. With higher cost of production and low supply the manufacturers are in steady state.

- The ongoing tensions between India and neighboring state have been a matter of concern. The neighboring state has cut down its all ties with India. Although this will not have major impact on India economy.

- Benzene the major source for aromatic products has also improved for this week. FOB Korea values for Benzene were assessed around USD 670/MT, increased by USD 20/MT for this week, while CFR China prices also improved and were assessed at the level of USD 660/MT for this week.

- Oil prices have been weakening in past few days as worries about the global economy weighed and equity markets were under pressure as uncertainty over the outlook for U.S. interest rate cuts left investors on edge.

- Traders are awaiting a speech from Federal Reserve Chair Jerome Powell on Friday in Jackson Hole, Wyoming, that could indicate whether the U.S. central bank will continue to cut interest rates.

- The market will be shifting focus today to broader based macro headlines with comments out of Jackson Hole likely to be prioritized in this regard.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $55.35/bbl. Prices have decreased by 0.33/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is decreased by 0.38/bbl in compare to last closing price and was assessed around $59.92/bbl.

$1 = Rs. 71.66

Import Custom Ex. Rate USD/ INR: 71.85

Export Custom Ex. Rate USD/ INR: 70.15