Methanol Weekly Report 22 Sep 2018

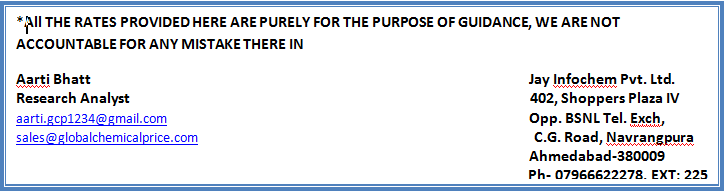

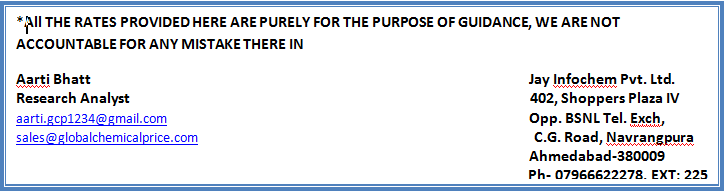

Weekly Price Trend: 17-09-2018 to 21-09-2018

- The above graph focuses on the Methanol price trend for the current week. Prices stable to firm for this week.

- By the end of the week prices were assessed around Rs 30.75/Kg for Kandla and Mumbai ports.

- There has been slight weakening in the values with bulk availability of stock at Indian ports.

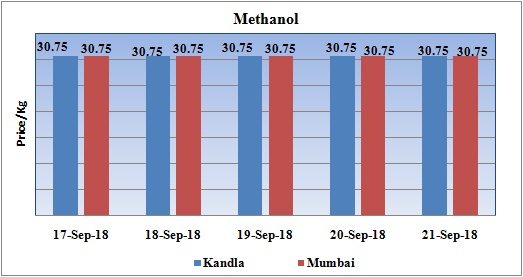

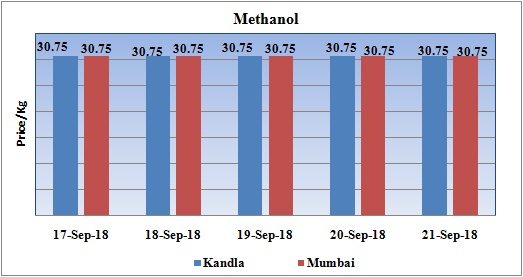

Total Methanol import in the month of August 2018

The above table depicts the import of Methanol in the month of August 2018. There has been abundant import in the month of August and bulk supply is available.

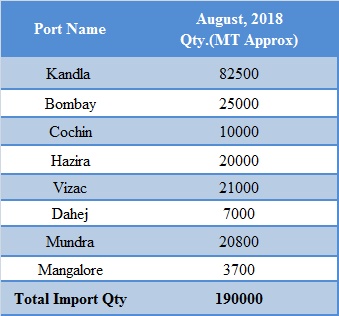

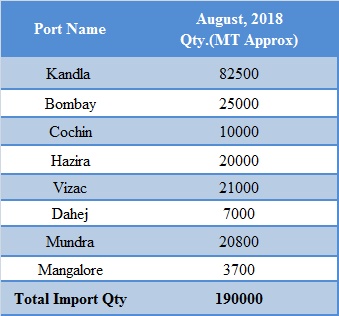

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices remained stable and were evaluated at Rs 30.75/kg for Kandla and Mumbai ports.

- CFR India prices were assessed around USD 365/MTS. CFR India prices reduced by USD 4/MTS for this week. There has been no major change in prices in domestic market and prices are likely to hover in this range in next week as well.

- Domestic prices are likely to go down further in next week. With long weekend ahead there will be comparatively slowdown in trading activities. Domestic manufacturer GNFC has reduced its domestic prices for Methanol to Rs. 29.40.

- China market is also operating at slow rate in current situation. Moreover it will remain closed till 24th of this month. There has been increase in China prices for Methanol for this week. Experts believe that this hike was expected in China. In the first week of October there will be long week vacation for national day celebration. So traders are in mood of collecting the stock and buffering it’s for the future use.

- Methanol prices in China’s Shandong are expected to stay firm in the near term on restocking activity due to tight supply. Plants scheduled turnarounds, and unexpected outages and unstable operations, of major methanol plants in September have tightened supply in Shandong. Outages at the two methanol plants of Shaanxi Shenmu Chemical forced the supply tightness.

- The sudden shutdown of Shaanxi Yulin’s methanol units forced the company to purchase methanol from the local market for its downstream methanol-to-olefin plant. As per report, downstream buyers are replenishing their stocks ahead of China’s Mid-Autumn and National Day holidays, providing further support to methanol prices. The Mid-Autumn Festival is on 22-24 September, while China’s National Day celebration is on 1-7 October. Presently market sentiment is bullish as September and October are the traditional peak demand season for methanol.

- With imposition of US tariffs on China the impact will be hurting the economies of the Asian countries. The effect will come into existence on 24th of this month. Still international market is yet to digest this sanctions, the US government has come up with fresh set of tariffs. The current tariffs are 10% and will rise to 25% from 1st Jan 2019.

- China in response to July sanctions has already imposed tariffs on imports from US. They may plant to retaliate further with this new announcement.

- There are many chemical products which are included in the $200 bn list of tariffs. Benzene, Phenol, Toluene, Petroleum Oils, Ethylene ,Propylene, o xylene, mixed xylene, para xylene, styrene, cumene, methanol are some of the crucial chemicals listed in this list.

- To retaliate back China will soon put forth its own lists of products. China has previously announced a 5%-25% tariffs on $60bn worth of US goods as its countermeasure to a further tariff action by the US. The US President has already announced it will impose tariffs on further $267bn worth of Chinese goods if China chose to retaliate again.

- The Organization of the Petroleum Exporting Countries and other producers, including Russia, meet on Sunday in Algeria to discuss how to allocate supply increases to offset the loss of Iranian barrels.

PLANT NEWS

Methanol plant to be shut down by IMC

Saudi Arabia based International Methanol Company (IMC) has shut down its Methanol unit for maintenance. The unit is based at Jubail in Saudi Arabia and has the manufacturing capacity of 1 mt/year.

IMC is a joint venture of Saudi International Petrochemical Co (Sipchem) and Japan-Arabia Methanol Co (JAMC).

Methanol plant shut down by Chongqing Kabeile

China based Chongqing Kabeile has shut down its Methanol unit for maintenance. The unit will shut down for its annual maintenance.

Unit is based at Chongqing in southwest China and has the manufacturing capacity of 8,50,000 mt/year.

Chongqing Kabeile Chemical is a subsidiary of Chongqing Chemical and Pharmaceutical Holding Group.

Coal India to set up Methanol plant in West Bengal

Coal India Ltd (CIL), one of the world’s largest coal miner is planning to set up an Methanol plant in West Bengal state of India. According to Chairman of CIL, “Steps have been taken towards methanol production, with the Centre recently easing norms for Coal India (CIL) to extract natural gas, coal bed methane from coal seams”. The unit will have the production capacity of 6.76lakh metric tonne per annum. The Methanol plant will be set up Dankuni Coal Complex (DCC) of South Eastern Coalfields Ltd (SECL), a subsidiary of the company. Pre-feasibility studies for the project have been completed, the source said, adding that financial aspects and timeline for the project were still being finalized. Methanol economy, if adopted by India, can be one of the best ways to mitigate the environmental hazards of a growing nation, it has said.

$1 = Rs. 72.19

Import Custom Ex. Rate USD/ INR: 73.65

Export Custom Ex. Rate USD/ INR: 71.95