Methanol Weekly Report 22 March 2019

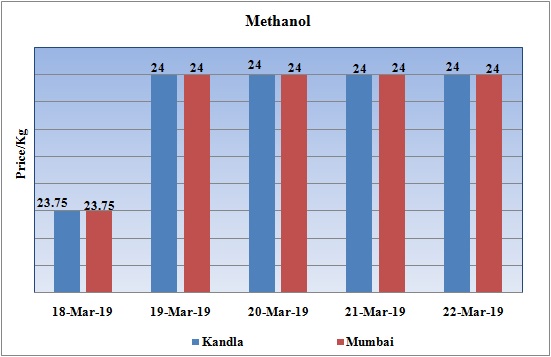

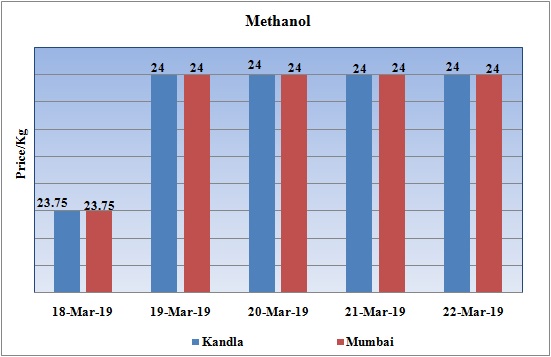

Weekly Price Trend: 18-03-2019 to 22-03-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week. There has slowdown in domestic prices and weakening of values continued throughout this week.

- By the end of the week prices were assessed around Rs 24/Kg for Kandla and Mumbai ports.

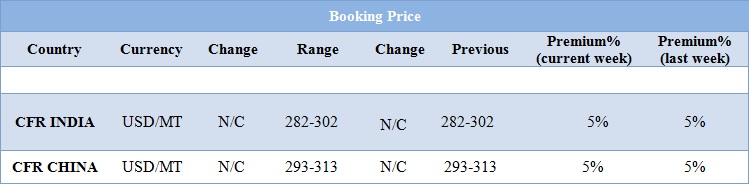

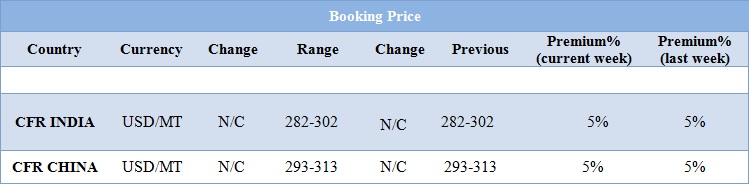

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained highly weak and feeble. Prices in the domestic market reduced to the level of Rs.24/Kg for this week.

- CFR India prices were assessed around USD 292/MTS, with no change in values for this week. On other side CFR China prices also remained stable and firm at the rate of USD 303/MT.

- There has been step sluggishness in the domestic prices for Methanol in the Indian domestic market. The restart of many units back in Middle East which are the suppliers for Methanol has put an additional pressure on pricing. The average pricing of Methanol for Kandla port and Mumbai in the month February has been around Rs.24.5/Kg.

- Buyers are believed to reduce their imports and will operate as per demand only till the end of the financial year next month.

- Indian currency has also strengthened against dollar in last few weeks. This has been one of the strongest performances of rupee against dollar since last few years.

- Crude prices continued its rally for this week. The oversupply of crude is no more in United States but it will not have major impact on prices.

- Many analysts and market observers believe that oil prices will move much higher with OPEC+ production cuts, declining U.S. inventories and a relatively strong global economy assuming that U.S.-China trade talks have a happy ending.

- Now Iranian customers have also started negotiating with the U.S. on possible waiver extensions to continue buying oil from Tehran.

- The U.S. waivers for eight key Iranian oil customers, including China, India, Japan, and South Korea, will expire in early May. While the U.S. Administration says that it continues to pursue zero Iranian oil exports, analysts expect Washington to extend waivers to at least a few of the currently exempted buyers, with reduced volumes allowed under the new waivers, as the Administration wouldn’t want to push oil prices too high.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $59.98/bbl. Prices have decreased by $0.25/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.64/bbl in compare to last closing price and was assessed around $67.86/bbl.

PLANT NEWS

Methanol plant shut down by Jiangsu Sopo of China’

- China based Jiangsu Sopo Chemical has shut down its Methanol unit. This was an unplanned shut down with no prior announcement. The unit has been shut down on back of facility issue.The unit is expected to resume its production in day or two.

- Unit is based at Jiangsu province of china and has the production capacity of 5,00,000 MT/year.

Methanol plant restarted by Datang Duolun

- Datang Duolun Petrochemical has restarted its Methanol plant. Earlier the unit was shut down in the first week of February for maintenance. The unit was shut down due facility issue. Unit is based at Duolun, Inner-Mongolia province, China and has the production capacity of 1.68 mln tonnes/year.

$1 = Rs. 68.95

Import Custom Ex. Rate USD/ INR: 70.00

Export Custom Ex. Rate USD/ INR: 68.35