Methanol Weekly Report 22 Feb 2019

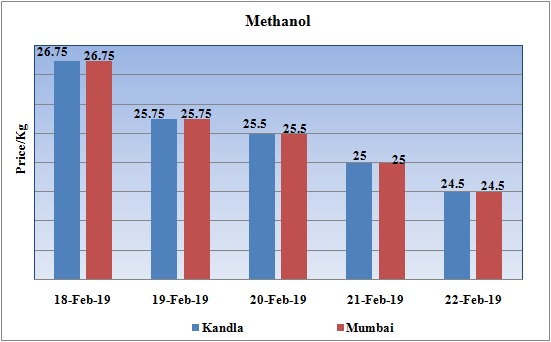

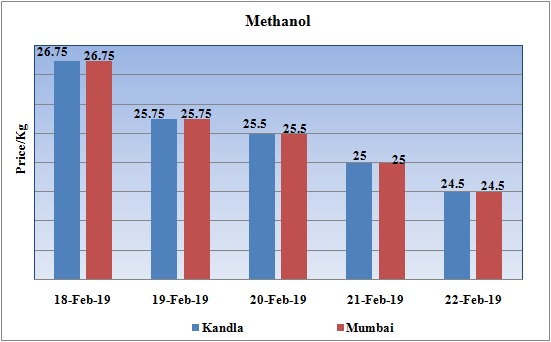

Weekly Price Trend: 18-02-2019 to 22-02-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week. There has slowdown in domestic prices and weakening of values continued throughout this week.

- By the end of the week prices were assessed around Rs 24.5/Kg for Kandla and Mumbai ports.

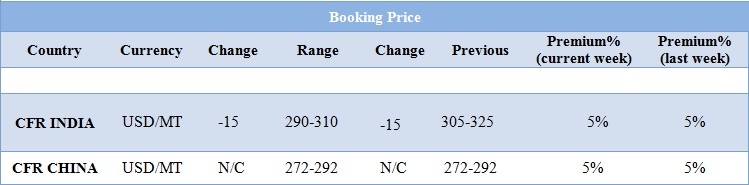

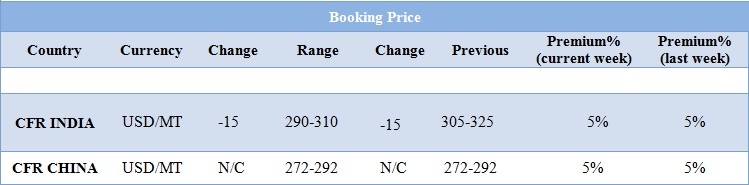

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained highly weak and feeble. Prices in the domestic market reduced to the level of Rs.24.5/Kg , decreased by Rs.2.25/Kg for this week.

- CFR India prices were assessed around USD 300/MTS, reduced by USD 15/MT for this week. On other side CFR China prices remained unchanged with no change in values. Methanol prices have been highly unpredictable and since last few weeks. With heavy inventory levels on Indian port, prices were predicted to show a downward trend.

- The recent terror attack on Indian military will have an adverse impact on Indian trade relation with neighboring nation. Moreover such heinous attacks affect the economy of the country as well.

- US crude has hit a new high in production this week. Prices on back of this production has hit to bottom despite of OPEC trying to withhold the production and tighten global markets.

- International Brent crude futures were at $66.87 per barrel at 0326 GMT, down 20 cents, or 0.3 percent, from their last close. U.S. West Texas Intermediate (WTI) crude oil futures were at $56.84 per barrel, down 12 cents, or 0.2 percent, from their last settlement.

- U.S. crude output has soared by almost 2.5 million bpd since the start of 2018, and by a whopping 5 million bpd since 2013. America is the only country to ever reach 12 million bpd of production.

- OPEC and some non-affiliated producers such as Russia agreed late last year to cut output by 1.2 million bpd to prevent a large supply overhang from growing. Another recent price driver has been U.S. sanctions against oil exporters Iran and Venezuela.

PLANT NEWS

MTO plant restarted by Sinopec Zhongyuan

- Sinopec Zhongyuan Petrochemicals will restart its Methanol to Olefins unit after brief maintenance. Earlier the unit was shut down in the month of November last year due to weak demand and sluggish requirement. Unit is based at Henan province of China and has the production capacity of 1,00,000mt/year.

$1 = Rs. 71.14

Import Custom Ex. Rate USD/ INR: 72.00

Export Custom Ex. Rate USD/ INR: 70.30