Methanol Weekly Report 20 September 2019

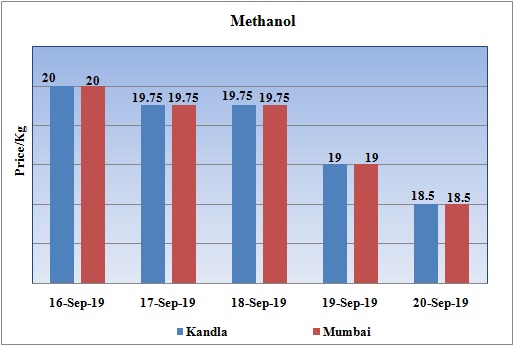

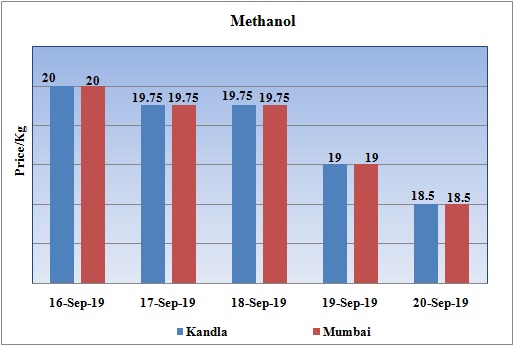

Weekly Price Trend: 16-09-2019 to 20-09-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.18.5/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 18.5/Kg for Kandla and Mumbai ports.

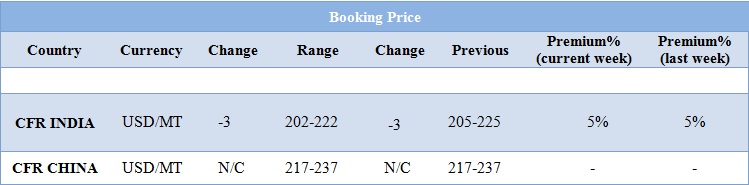

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market reduced slightly for this week and were assessed at the level of Rs.18.5/Kg for bulk quantity.

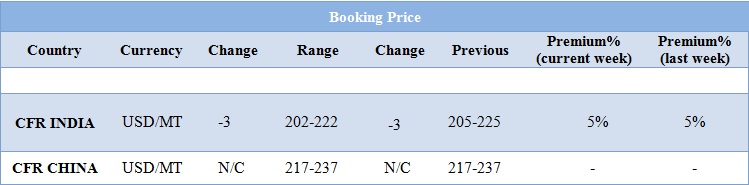

- CFR India prices were assessed around USD 212/MTS, reduced by USD 3/MTS for this week. With ongoing monsoon season at its peak there has been significant decline in demand for Methanol.

- CFR China prices were assessed around USD 217-237/MT, with no change in values in compare to last week’s closing values for this week.

- Benzene the major source for aromatic products has also improved for this week. FOB Korea values for Benzene were assessed around USD 720/MT, increased by USD 20/MT for this week, while CFR China prices also improved and were assessed at the level of USD 735/MT for this week.

- Oil prices rose sharply on Thursday, supported by supply risks as the market assesses the fallout from last weekend's drone attacks on Saudi oil infrastructure.

- The attacks knocked out around half of Saudi Arabia's crude production and severely limited the country's spare capacity, a cushion for oil markets in any unplanned outage.

- "Global available spare capacity is extremely low at present following the weekend attacks, leaving little room for additional outages, which tends to be price supportive," UBS oil analyst Giovanni Staunovo said.

- Earlier this week Saudi Arabia set out a timeline for a resumption of full operations, saying it had restored supplies to customers at levels prior to the attacks by drawing from its oil inventories.

- It said it would restore its lost production by the end of this month, and bring its output capacity back to 12 million barrels per day by the end of November.

- "These plans suggest Saudi Arabia will have no spare capacity for at least the next two and a half months and therefore no way to absorb any further shocks," consultancy Energy Aspects said.

- Saudi Arabia, the world's leading oil exporter, has said the crippling attack on its oil sites was "unquestionably sponsored" by regional rival Iran.

MTO unit restarted by Shenhua Coal Co

- Shenhua Coal to Liquid and Chemical Co has restarted its Methanol-to-Olefins unit after brief maintenance. Earlier the unit was shutdown in the month of July for an annual maintenance. The unit has restarted its production in last week. Unit is based at Yulin in Shaanxi in China and has the production capacity of ethylene around 300,000 mt/year and propylene capacity of 300,000 mt/year.

MTO unit restarted by Shandong Yangmei Hengtong Chemical

- Shandong Yangmei Hengtong Chemical has restarted its Methanol-to-Olefins unit after brief maintenance period. Earlier the unit was shutdown in the month of July for an annual maintenance schedule. Unit has resumed its production in last month.

- Unit is based at Shandong province of China and has the production capacity of ethylene production capacity of 120,000 mt/year and propylene capacity of 180,000 mt/year.

$1 = Rs. 71.04

Import Custom Ex. Rate USD/ INR: 72.20

Export Custom Ex. Rate USD/ INR: 70.50