Methanol Weekly Report 20 Oct 2018

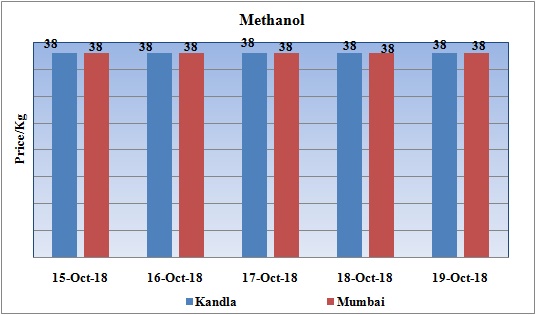

Weekly Price Trend: 15-10-2018 to 19-10-2018

- The above graph focuses on the Methanol price trend for the current week. Prices increased heavily for this week in domestic market.

- By the end of the week prices were assessed around Rs 38/Kg for Kandla and Mumbai ports.

- Domestic prices have increased by Rs.0.50/Kg for bulk quantity in the span of one week. Rise has been rise in domestic values on back of limited supply in domestic market.

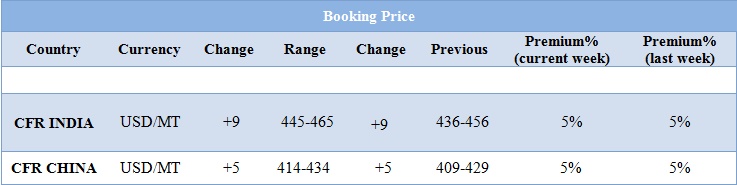

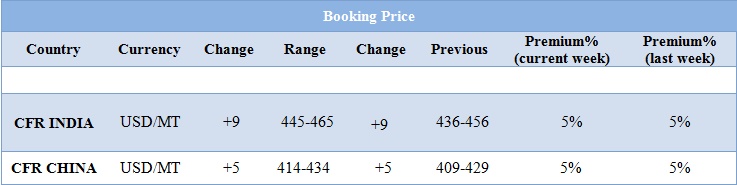

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol prices remained firm and increased by Rs.50/Kg by end of the week and were assessed at the level of Rs 37.25/kg for Kandla and Mumbai ports.

- CFR India prices were assessed around USD 455/MTS, increased by USD 9/MT for this week. On other side CFR China prices were assessed around USD 424/MT increased by USD 5/MT for this week.

- This unprecedented hike has affected significantly the Indian domestic market. Domestic market surge up incredibly in next week.

- Prices in the US market have also increased unprecedentedly and are on continuous surge. Experts believe that production outage in Trinidad and Tobago could be exerting the upward pressure.

- There has been significant decline in crude prices in last two weeks. Prices plunged by more than 11 % in last two weeks. Oil prices rose to nearly four-year highs at the start of October as there has been depletion in crude supply sue to US sanctions on Iran.

- Rising U.S. crude stockpiles, forecasts for slower-than-expected demand growth and a sell-off in stock markets have weighed on crude futures.

- The supply of oil held in U.S. storage tanks has risen sharply over the last four weeks. U.S. crude stockpiles are up by 22.3 million barrels through last week. That's the biggest increase over that four-week period since 2015, when storage levels were rising toward all-time highs in a heavily oversupplied market.

- The market remains uncertain about the ability of producers such as Saudi Arabia and Russia to fill the gap left by the loss of roughly 1 million barrels a day of Iranian exports. Analysts say the market is deeply cynical that Riyadh would cut output and push oil prices higher to settle a political score.

PLANT NEWS

Methanol facility to be built at Alberta by Nauticol Energy

- Nauticol Energy is planning to built a world class methanol facility worth 2 billion dollar in northern Alberta. The plant will be based at Grande Prairie and will have the manufacturing capacity of 3 million mt per year. “This is a made-in-Alberta, made-for-Albertans project that will add tremendous economic, environmental and societal benefits both here and around the world,” said president and CEO Mark Tonner, in a statement.

- The facility will create 75,000 people-years of employment for Alberta and will add value to the province’s natural gas supply. The methanol plant is scheduled to begin operations in 2021. Most of the methanol will be exported to Asia that makes up 70% of the global demand, the company said.

- The facility would be built in an already-developed industrial area next to an existing pulp mill. The plant would be built in three stages using a modularized design, starting next year. The modules will be built by PCL Construction at Alberta facilities and moved to the site about 6 miles south of Grande Prairie.

$1 = Rs. 73.32

Import Custom Ex. Rate USD/ INR: 74.30

Export Custom Ex. Rate USD/ INR: 72.60