Methanol Weekly Report 20 June 2019

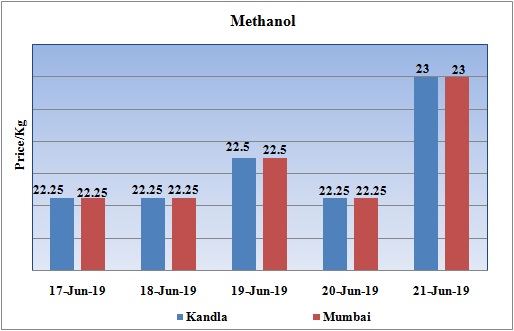

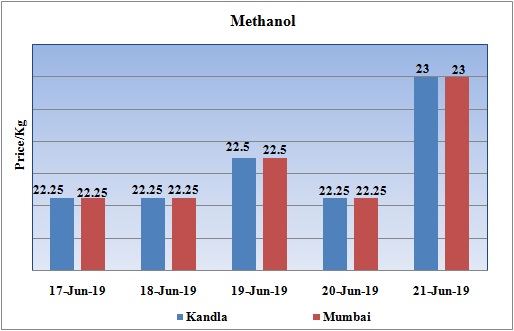

Weekly Price Trend: 17-06-2019 to 21-06-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.23/Kg for bulk quantity by end of the week. Prices increased by Rs.0.75/Kg for this week from last week are closing values.

- By the end of the week prices were assessed around Rs 23/Kg for Kandla and Mumbai ports.

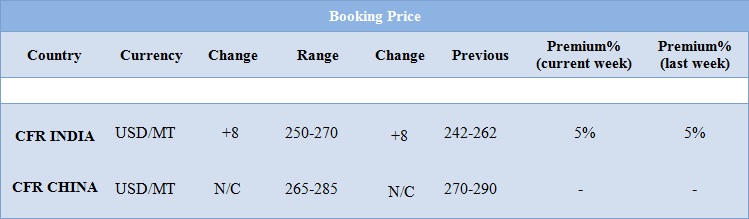

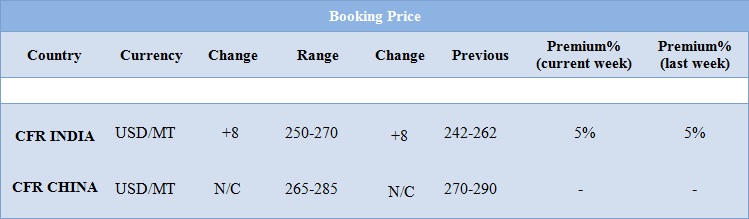

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market improved and were assessed at the level of Rs.23/Kg for this week.

- CFR India prices were assessed around USD 256/MTS, increased by USD 8/MT for this week.

- With continuous decline in values since last two months, this is first time that there has been increase in values. Although rise has been meager still market has been on improving mood significantly due to increase in crude prices in international market.

- The extensive summer in the country has been affecting a lot to the western and northern part of the country. Hard heat wave has derailed the work at many ports including Kandla where temperature is soaring to the level of 48-49 degrees.

- Severed tension between Iran and US has resulted in the soaring of crude values in international market. In the early hours on Thursday, Iran shot down a U.S. drone, with both sides reporting conflicting accounts. The U.S. says the drone was in international waters, while Iran says that the drone had entered Iranian air space. The incident adds to the boiling cauldron of tension between the two countries.

- In early trading on Thursday, WTI was up more than 4 percent and Brent was up more than 3 percent, surging to the highest level since late May.

- The confused policy of US against Iran has been the talk of town. With no proper reasons US has been escalating the tension and has been prompting Iran to take any major negative step.

- The rapid spike in tension has only moved crude oil prices in fits and starts over the last few weeks. The prospect of a major war, and the potential disruption to maritime trade in the Persian Gulf, was largely shrugged off by oil traders.

$1 = Rs. 69.55

Import Custom Ex. Rate USD/ INR: 70.40

Export Custom Ex. Rate USD/ INR: 68.70