Methanol Weekly Report 19 Aug 2017

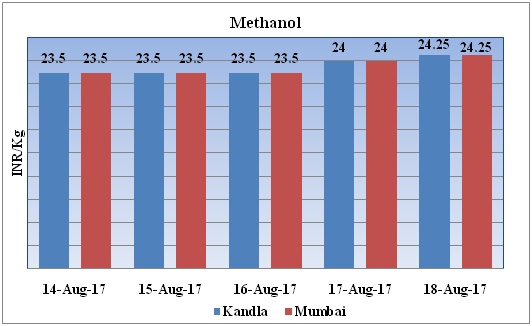

Weekly Price Trend: 14-08-2017 to 18-08-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed up inclination for this week. By the end of the week prices were assessed around Rs.24.25/Kg for Kandla and Rs 24.25/kg Mumbai ports.

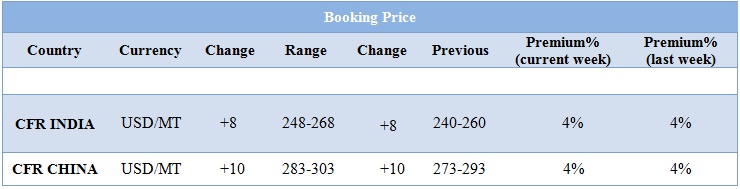

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up inclination and by the end of the week prices were evaluated at Rs 24.25/kg for Kandla and Rs 24.25/kg for Mumbai ports.

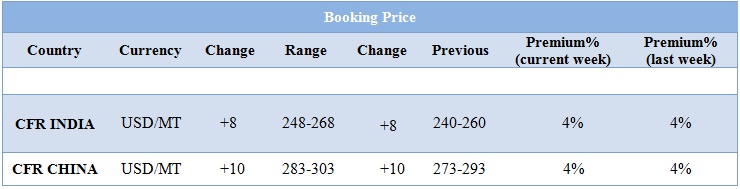

- CFR India prices were assessed in the range of USD 248-268/MTS. Prices have increased in compares to previous week.

- This week in China market prices have decreased CFR China prices were assessed at the level of USD 293/mt.

- For the month of July South Korea’s methanol imports plunge 1.7%.

- EU methanol net imports crash by a fifth in June.

- Russian methanol producer Metafrax will shut its methanol unit for schedule maintenance turnaround. The shut down period is likely to last for 2-3 weeks. The restart date for unit has not been specified yet. Unit is based at Russia and has the manufacturing capacity of 1 mt/year.

- Presently methanol market is moving with upward note with good demand sentiments from end users.

- Qinghai Zhanghao has shut down its Methanol plant for maintenance schedule. This is one of the major domestic producer of Methanol in China. This unit has the production capacity of 600 kt/year. The unit was shut down on 31st July and will remain off-stream for around one month.

- In China market there has been reverse in the market trend. By second half of June the methanol market follows the uptrend commodity futures.

- As a result the demand remains weak and bit slow. By starting of August the supply is expected to see an upward trend.

- Shandong ENN is likely to expand its existing methanol production capacity. The unit is based in the Shnadong province of China. The unit will increase its production capacity by 300 KT/year. The company will start its unit is the August end or September. Mingshui Dahua’s 600kt/yr new unit and 350kt/yr old unit in Shandong are both likely to run normally from August.

- Adding to that is the expectation of the startup of Luxi Chemical’s fresh capacity in Aug-Sep. On contrary the traditional demands for downstream industries continue to remain slow.

- The demand from MTO plants is also bearish and will gain momentum only after few months.

- This week oil prices have varied and on Thursday oil prices rose as renewed attention were put on U.S. oil stockpile declines at Cushing, the delivery hub for U.S. crude futures.

- On Thursday, closing crude values have increased.WTI on NYME closed at $47.09/bbl, prices have increased by $0.31/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.76/bbl in compared to last trading and was assessed around $51.03/bbl.

- Market players are anticipating that crude oil prices to trade sideways on the back of short covering after drop in prices.

- As per market predictors, the oil market has experienced a high level of disruptions to crude supply in recent years. Prices could spike above $70 a barrel if recently restored production in Nigeria and Libya falls again. But it could also sink below $40 if disruptions elsewhere in the world get resolved, putting more crude oil into the market.

$1 = Rs. 64.14

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.45