Methanol Weekly Report 19 April 2019

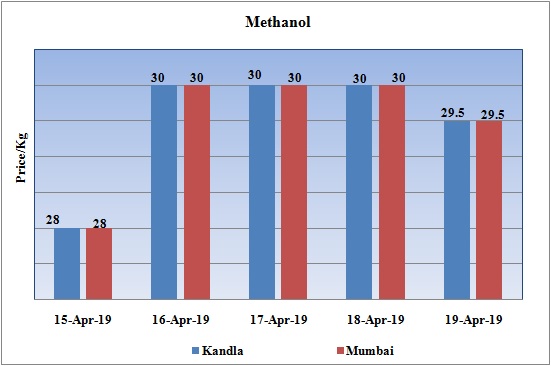

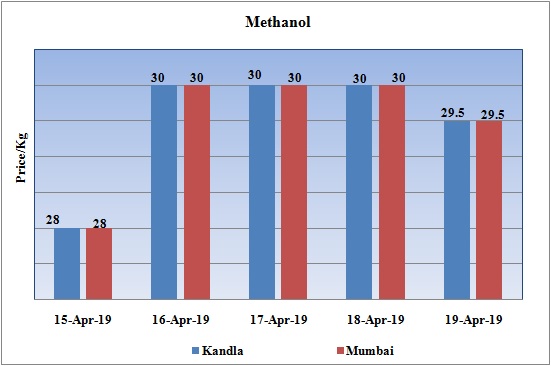

Weekly Price Trend: 15-04-2019 to 19-04-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained firm and increased for this week. Domestic prices were assessed at the level of Rs.29.5/Kg for bulk quantity.

- By the end of the week prices were assessed around Rs 29.5/Kg for Kandla and Mumbai ports, prices increased by Rs.2.5/Kg for this week.

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained firm and increased by Rs.2.5/Kg for this week. Prices in the domestic market improved and were assessed at the level of Rs.29.5/Kg for this week.

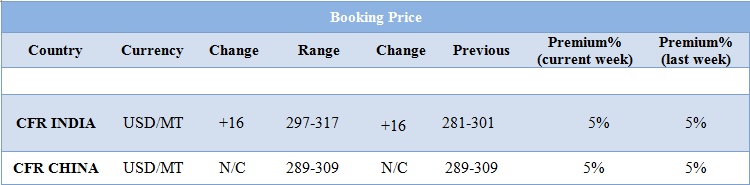

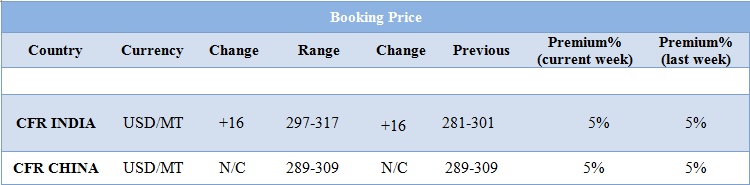

- CFR India prices were assessed around USD 307/MTS, increased by USD 16/MT in values in compare to last week’s closing values. On other side CFR China prices also remained firm for this week at the level of USD 289-309/MT, with no change in values.

- In last two weeks there has been significant improvement in domestic values for Methanol. The sole reason behind this hike in shortage in the supply. The decline in supply is not due to shortage in production but because of unavailability of berth at Indian ports. Ports are already overloaded with other stocks and huge accumulation of vessels.

- The major supplier of Methanol is Iran and it has curtailed its supply due to some unexpected plant shutdowns. This short supply at Indian ports is likely to stay for two to three weeks as Iran has been reluctant to make any fresh deals.

- The scenario will improve in the mid of next month. However demand in domestic market is limited with not so good requirement from downstream industry.

- The election period going in the country has been major factor affecting the sentiments for Indian economy. Traders are in mood to know first about the government to take lead and then make any fresh position in the market.

- Crude has been on upward trajectory since past few weeks, but with slowdown in buying has led to correction in values.

- The renewed concerns over rising US inventory and production as well as concerns over a global economic slowdown helped put a lid on the prices.

- On the demand front, China’s state-owned energy giant Sinopec had resumed buying US oil, which was bullish for the market. The EIA reported that US crude exports to China had dried up from mid-2018 through recent weeks, after having averaged over 300,000 bpd in first half of last year.

PLANT NEWS

Methanol capacity to be expanded by Celanese

- Celanese soon make an significant expansion of its Methanol capacity at its Clear Lake acetyl intermediates manufacturing facility in Pasadena, Texas. The approval has been granted from the board of directors of Fairway Methanol joint venture (JV) with Japan’s Mitsui & Co for a second phase expansion. The new expansion will increase the production to 1.7mtonnes/year. Earlier this unit was commissioned in 2015with a capacity of 1.3mtonnes/year. The existing methanol unit utilizes low-cost natural gas in the US Gulf Coast region as a feedstock.

- The JV operates as Fairway Methanol LLC, with both Celanese and Mitsui maintaining a 50/50 ownership.

$1 = Rs. 69.35

Import Custom Ex. Rate USD/ INR: 70.40

Export Custom Ex. Rate USD/ INR: 68.70