Methanol Weekly Report 18 March 2017

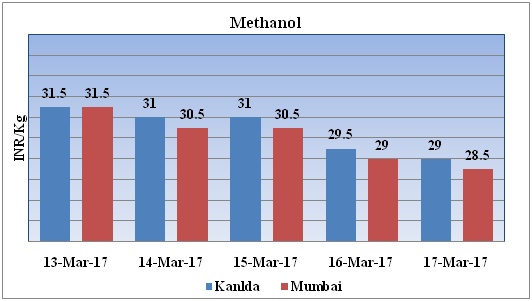

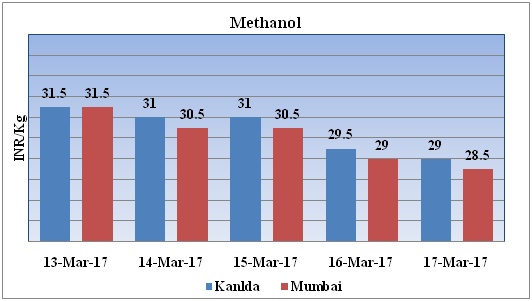

Weekly Price Trend: 13-03-2017 to 17-03-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.29/Kg for Kandla and Rs 28.5/kg Mumbai ports.

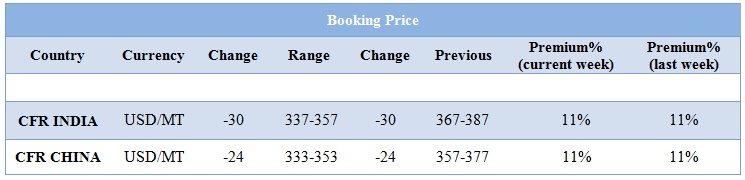

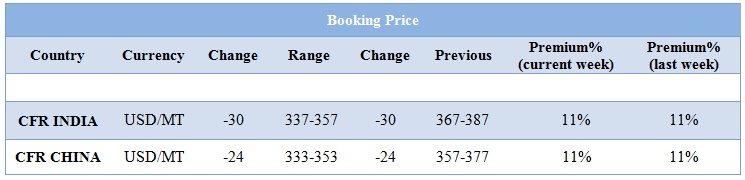

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 29/kg for Kandla and Rs 28.5/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 337-357/MTS. Prices have plunged in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 400/mt.

- CFR China prices were assessed in the range of USD 333-353/MT prices have decreased in compares to previous week.

- Recently methanol market is moving with weak velocity market players have been uncertain for upcoming market outlook.

- This week Asian methanol remained mixed with China plunged by ample domestic supply while India remains tight because of maintenance at plants in Iran, said by market players.

- In China downstream sectors demands also has been bearish on account of this methanol prices have plunged.

- As per report, recently Chinese buyers are not buying much as anticipated stocks of blended gasoline.

- This week oil prices have followed mixed trend. On Thursday oil prices have plunged after a big increase as rising output from the U.S. remained a threat to efforts by other major producers to rebalance the market.

- Oil prices continued to find some support Wednesday prices showing the drop in U.S. crude supply in, as well as weaker dollar in the wake of the Federal Reserve’s less-hawkish-than-expected rate announcement.

- As per report, Global oil inventories rose for the first time in six months in January, despite the OPEC agreement. Iraq is planning to boost output later in the year even as the OPEC member reaffirmed its commitment to the group’s decision to cut production to counter a global glut.

- Some market players have said t hat in near term crude oil prices to trade positive on the back of surprise drawdown in U.S. crude inventories.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $48.75/bbl, prices have decreased by $0.11/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.07/bbl in compared to last trading and was assessed around $51.74/bbl.

$1 = Rs. 65.46

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50