Methanol Weekly Report 17 June 2017

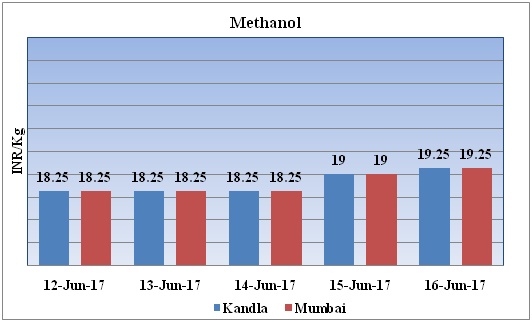

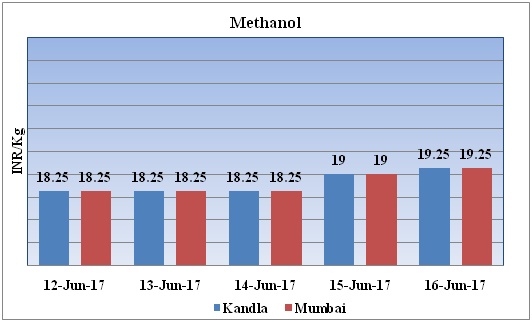

Weekly Price Trend: 12-06-2017 to 16-06-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed up inclination for this week. By the end of the week prices were assessed around Rs.19.25/Kg for Kandla and Rs 19.25/kg Mumbai ports.

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up inclination and by the end of the week prices were evaluated at Rs 19.25/kg for Kandla and Rs 19.25/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 230-250/MTS. Prices have decreased by USD 5/mt in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 280/mt.

- CFR China prices were assessed in the range of USD 260-280/MT prices have increased by USD 5/mt in compares to previous week.

- This week in domestic market methanol demand sentiments have improved which has resulted in increase in the prices.

- This week China methanol market was moving with volatile velocity.

- Some market players have said that presently market outlook has been uncertain in China.

- As per report, in near term so many methanol plants are going to resume their production in China which will increase the material availability in market.

- The operations of some downstream plants are impacted by rainfalls in South China and wheat harvest in North China.

- The consumption enters into dull season with temperature getting higher. Therefore, demand for methanol is expected to be stable-to-weaker.

- As per report, Sailboat Petrochemical will not raise MTO operating rate to 100% till the end of July.

- Malaysia’s PETRONAS methanol plant restarted on 15 June.

- Singapore May petchem exports grow 19.3% on year, as per news.

- As per source info, China’s Connell to commission MTO project in late 2017-2018.

- This week oil prices have followed volatile trend and on Thursday oil market has closed on downward note. This week the global oil market have remained awash in surplus oil, rising U.S. crude production and weak domestic gasoline demand kept pressure on prices.

- As per report, the outlook for the energy market will remain bearish. OPEC’s agreement with non-OPEC members “remains brittle as none of those participating are happy about the arrangement. In the U.S., the trend of rising production remains strong while gasoline demand has been soft so oil production is expected to continue to rise steadily this summer. High exports and production from other countries, including Russia and the United States, are also contributing to the ongoing glut.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $44.46/bbl, prices have decreased by $0.27/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.08/bbl in compared to last trading and was assessed around $46.92/bbl.

$1 = Rs. 64.42

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.50