Methanol Weekly Report 17 January 2020

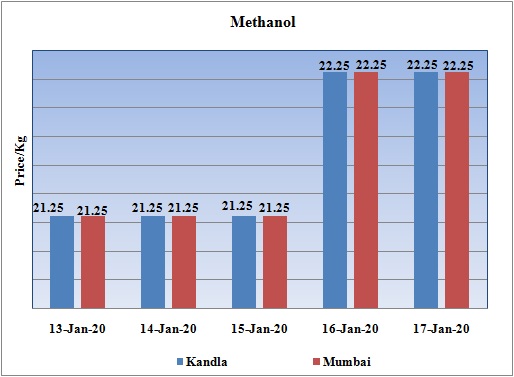

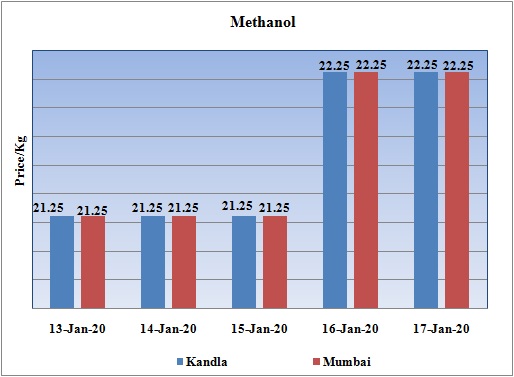

Weekly Price Trend: 13-01-2020 to 17-01--2020

- The above graph focuses on the Methanol price trend for the current week. Prices remained soft-to-firm throughout this week. Domestic prices were assessed at the level of Rs.22.25/Kg for bulk quantity although closed on lower note in compare to last week’s closing values.

- By the end of the week prices were assessed around Rs 22.25/Kg for Kandla and Mumbai ports.

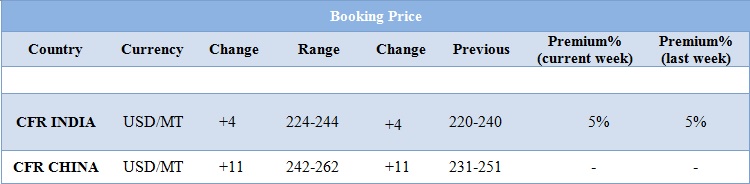

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have remained soft-to-stable throughout this week. There has been slight improvement in the demand sentiments. Prices in the domestic market were assessed at the level of Rs.22.25/Kg for bulk quantity.

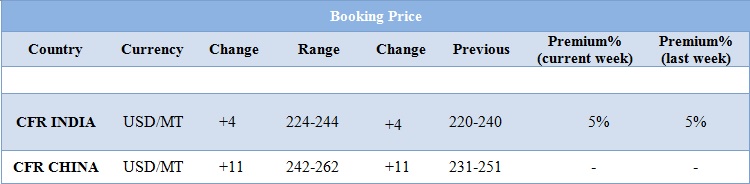

- CFR India prices were assessed around USD 234/MTS, a rise of USD4/MT for this week. This rise has been in particularly due to rise of tension between Iran and US.

- CFR China prices were assessed around USD 242-262/MT, with an increase of USD 11/MT for this week.

- Benzene the major source for aromatic products also remained variable this week. FOB Korea values for Benzene were assessed around USD 715/MT for this week, while CFR China prices were assessed at the level of USD 740/MT for this week.

- Indian market remained subdued for this week due to festive season across the country. The market will get into proper mood by next week. Moreover the other major countries of Asia, soon will be going for a long holidays for celebrating Lunar vacation. So the major purchasing and clearing of existing stocks will be taking place in the upcoming week which will be again very crucial for world economic dynamics.

- In the fourth quarter of 2019, the world's second-largest economy grew by an expected 6 per cent from a year earlier, while the full-year expansion was 6.1 per cent, the slowest in 29 years, as per the government data.

- On other side India and the United States will discuss India’s energy security and the Asian country buying increased volumes of U.S. crude oil when U.S. President Donald Trump and Indian Prime Minister Narendra Modi meet later this year.

- India was until recently Iran’s second-largest oil customer after China, but the U.S. sanctions on Iranian oil exports made India stop purchases of oil from Iran as refiners did not want to risk secondary U.S. sanctions if they continue doing business with Tehran.

- On Thursday, closing crude values have increased. WTI on NYME closed at $58.52/bbl. Prices have increased by 0.71/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.62/bbl in compare to last closing price and was assessed around $64.62/bbl.

PLANT NEWS

QAFAC shut down its Methanol plant

Qatar Fuel Additive Co (QAFAC) has shut down its Methanol plant due to its technical issues. The operations have been put on halt in the first week of January 2020. Company has not specified yet for how long the unit is likely to remain off-stream.

Unit is based at Messaieed in Qatar, the natural gas based Methanol plant has a production capacity of 1.1 mln mt/year.

Methanol plant was shut down by Kaveh Methanol

Methanol was shut down by Kaveh Methanol due to shortage in the supply of natural gas. Since natural gas is the feedstock supply for Methanol plant. The unit was shut down last week and is likely to last till winter season in Iran. The government of feedstock supply of natural gas has been curtailed as it has been diverted towards domestic sector.

$1 = Rs. 71.08

Import Custom Ex. Rate USD/ INR: 71.65

Export Custom Ex. Rate USD/ INR: 69.95