Methanol Weekly Report 15 March 2019

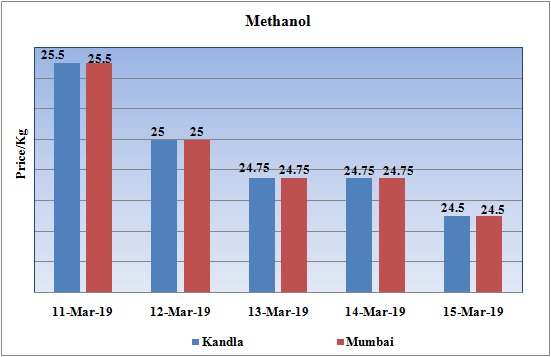

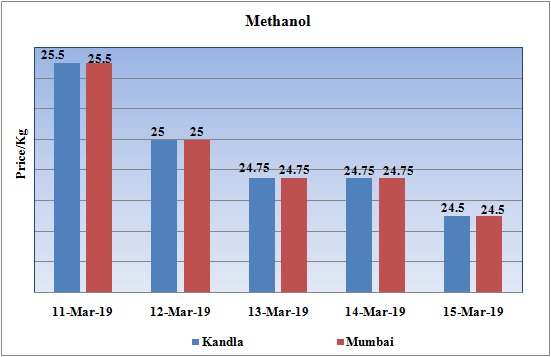

Weekly Price Trend: 11-03-2019 to 15-03-2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained highly vulnerable for this week. There has slowdown in domestic prices and weakening of values continued throughout this week.

- By the end of the week prices were assessed around Rs 24.5/Kg for Kandla and Mumbai ports.

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained highly weak and feeble. Prices in the domestic market reduced to the level of Rs.24.5/Kg for this week.

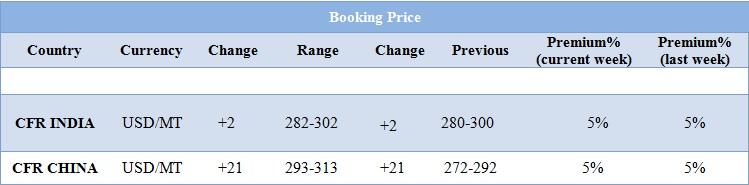

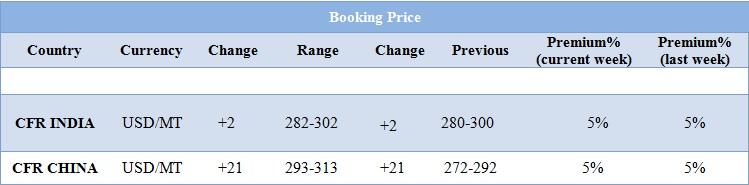

- CFR India prices were assessed around USD 292/MTS, slightly improved by USD 2/MT for this week. On other side CFR China prices has improved significantly. Since last three weeks there was no change in China values. This week prices increased by USD 21/MT and were assessed at the level of USD 303/MT.

- There has been step sluggishness in the domestic prices for Methanol in the Indian domestic market. The restart of many units back in Middle East which are the suppliers for Methanol has put an additional pressure on pricing. The average pricing of Methanol for Kandla port and Mumbai in the month February has been around Rs.24.5/Kg.

- Buyers are believed to reduce their imports and will operate as per demand only till the end of the financial year next month.

- Restart of units in Iran, Indonesia has set the platter of material for India but the Indian buyers are making purchase very cautiously.

- Spot prices for Methanol in Europe have set on high due to ongoing sanctions and political tensions between Venezuela and the US. European spot prices increased to €281-286/tonne on a FOB (free on board) Rotterdam basis in the week ending Friday 8 March, while US spot prices were at 108-109cts/US gal. In dollar terms, the spread between the two remains significant.

- "Production is still running, export is possible but not to us. If not Europe the methanol will go to China. Some market players are hesitant from taking Venezuelan methanol, worried that they could be slapped with retrospective sanctions from the US, trader feedback suggested.

- This could leave Europe or other production centres nearby to step into the breach and supply methanol to the US. The US has significant methanol capacity, so one methanol source suggested that plants there may be able to plug any local US gap and leave the Venezuelan material for other markets such as Asia. That said, material from Venezuela to Asia is not an unusual flow.

- On Thursday, closing crude values have mixed. WTI on NYME closed at $58.61/bbl. Prices have increased by $0.35/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.32/bbl in compare to last closing price and was assessed around $67.23/bbl.

PLANT NEWS

Methanol plant restarted by Datang Duolun

- Datang Duolun Petrochemical has restarted its Methanol plant. Earlier the unit was shut down in the first week of February for maintenance. The unit was shut down due facility issue. Unit is based at Duolun, Inner-Mongolia province, China and has the production capacity of 1.68 mln tonnes/year.

Methanol plant shut down by Qatar Fuel Additives (QFAC)

- QFAC will restart its Methanol unit after brief maintenance. The unit has been shut down on 22 February and is likely to remain off-stream for around 5-6 weeks. The restart is date likely to be around 7thapril.

- Unit is based at Mesaieed in Qatar and has the production capacity of 1,100 mt/year.

$1 = Rs. 69.09

Import Custom Ex. Rate USD/ INR: 71.00

Export Custom Ex. Rate USD/ INR: 69.30