Methanol Weekly Report 13 Jan 2018

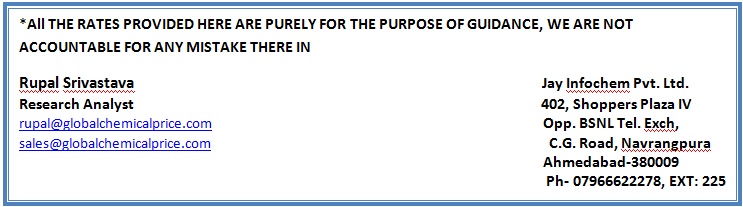

Weekly Price Trend: 08-01-2018 to 12-01-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed up-to-soft for this week. By the end of the week prices were assessed around Rs 31.75/Kg for Kandla and Rs 31.75/kg Mumbai ports.

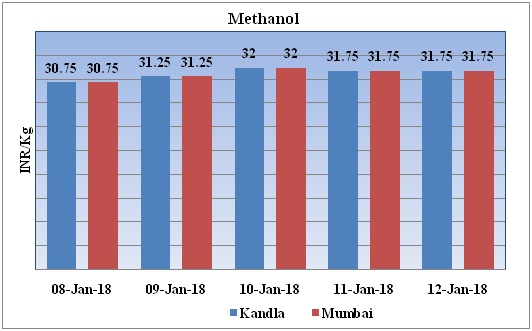

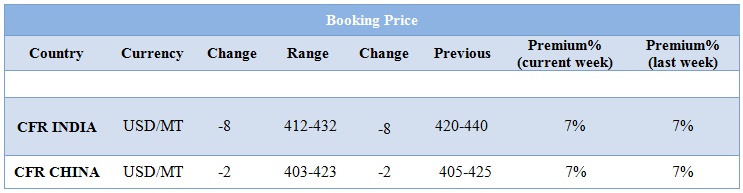

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up-to-soft trend and by the end of the week prices were evaluated at Rs 31.75/kg for Kandla and Rs 31.75/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 411-432/MTS. Prices have decreased by USD 8/mt in compares to previous week.

- This week methanol prices have plunged on bearish demand sentiments from end users.

- CFR China prices of methanol were evaluated at USD 413/mt.

- US November methanol exports jump 26%, imports drop 3.7%.

- A huge methanol project has been announced in Louisiana in US by IGP Methanol. It plans to build four units each having the production capacity of 1.8m tonnes/year. Once completed, the company’s Gulf Coast Methanol Park would produce 7.2m tonnes/year of methanol, larger than total US production now. Company has not disclosed any cost or investment figure for this project.

- This week crude oil prices have followed up velocity. On Thursday Brent crude oil hit a more than three-year high breaking through the psychologically important $70 a barrel level for the first time since December 2014.

- On Thursday, closing crude values have increased. WTI on NYME closed at $63.80/bbl; prices have increased by $0.23/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.06/bbl in compared to last trading and was assessed around $69.26/bbl.

- Oil prices have been supported by stronger-than-expected demand fueled by worldwide economic growth, ongoing output limits by OPEC and Russia and a series of global events that have stoked geopolitical tension.

- Market analysts say it will be hard for oil prices to tack on gains from these levels. Robust global demand, OPEC output cuts and a series of geopolitical tensions have accelerated a rally that began in June.

$1 = Rs. 63.61

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.80