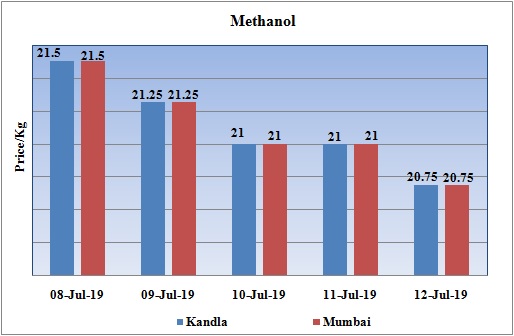

Methanol Weekly Report 12 July 2019

Weekly Price Trend: 01-07-2019 to 05-07-2019

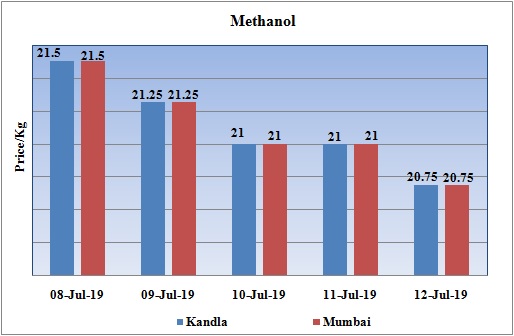

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.20.75/Kg for bulk quantity by end of the week. Prices reduced significantly by Rs.0.75/Kg for this week.

- By the end of the week prices were assessed around Rs 20.75/Kg for Kandla and Mumbai ports.

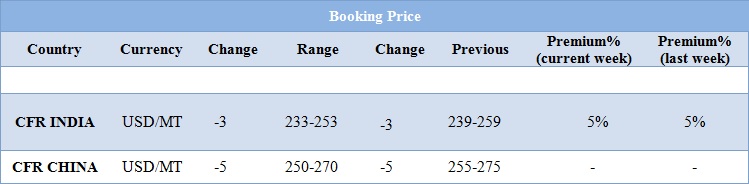

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable there was a constant variation in the values. Prices in the domestic market reduced significantly for this week and were assessed at the level of Rs.20.75/Kg for bulk quantity.

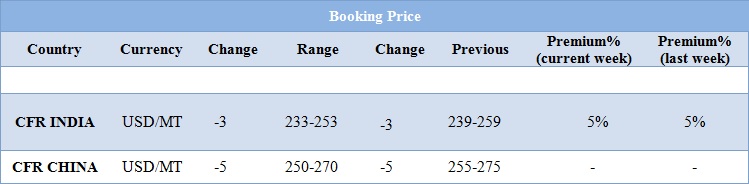

- CFR India prices were assessed around USD 243/MTS, reduced by USD 3/MT for this week. With ongoing monsoon season at its peak there has been significant decline in demand for Methanol. There has been slowdown in demand from domestic market due to monsoon across the nation.

- CFR China prices were assessed around USD 250-270/MT, reduced by USD 5/MT for this week.

- Market will react more aggressively in India as today first budget has been declared by the new government. The implication of budget on petrochemical segment will be visible on Monday.

- Crude oil prices rose 0.61 percent to Rs 4,157 per barrel in futures trade on July 12 as speculators raised their exposure, tracking a rebound in global markets.

- Non-OPEC crude oil supply will rise by 2.4 million bpd next year, OPEC said in its latest Monthly Oil Market Report.

- The cartel added that the rise would be driven by the addition of new pipeline capacity in North America, most likely meaning the United States as Canada’s pipeline woes continue and Mexico struggles to reverse declining production. In fact, OPEC mentioned the natural decline of production in Mexico would offset the effect of rising non-OPEC supply somewhat.

- It’s not just the U.S. that will expand production, however. New projects in Norway, Brazil and Australia will also contribute to the increase in non-OPEC supply.

- On Thursday day, closing crude values have decreased. WTI on NYME closed at $60.20/bbl. Prices have decreased by 0.23/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is decreased by 0.49/bbl in compare to last closing price and was assessed around $66.52/bbl

CFR CHINA

- With start up of new Methanol-to-Olefins unit in China the demand for Methanol is likely to gain a significant boost in next few weeks. The MTO unit – with designed capacities of 240,000 tonnes/year for ethylene and 360,000 tonnes/year for propylene - started trial runs on last week.

- Further Luxi Chemical and Zhong’an Lianhe Chemical were also expected to start conducting trial runs at their plants in July. Luxi Chemical’s 290,000 tonne/year MTO unit in Shandong province has its own methanol units. Once the MTO unit start-up, the company will stop selling methanol and sell olefins instead.

- Zhong’an Lianhe Chemical’s 600,000 tonne/year coal-to-olefin (CTO) unit in Anhui province has its own downstream polypropylene (PP) and polyethylene (PE) units. Further more such units are likely to get start up by October-November of this month.

$1 = Rs. 68.68

Import Custom Ex. Rate USD/ INR: 69.75

Export Custom Ex. Rate USD/ INR: 68.05