Methanol Weekly Report 11 October 2019

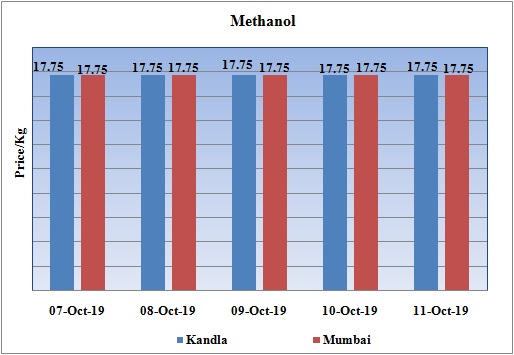

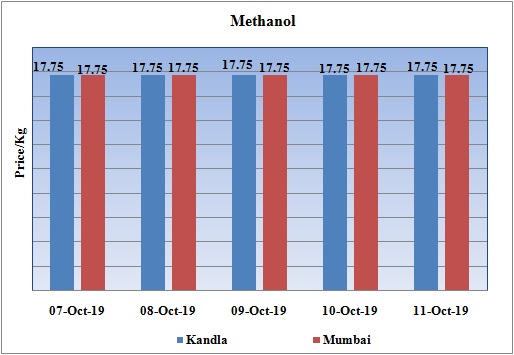

Weekly Price Trend: 07-10-2019 to 11-10--2019

- The above graph focuses on the Methanol price trend for the current week. Prices remained vulnerable throughout this week. Domestic prices were assessed at the level of Rs.17.75/Kg for bulk quantity by end of the week.

- By the end of the week prices were assessed around Rs 17.75/Kg for Kandla and Mumbai ports.

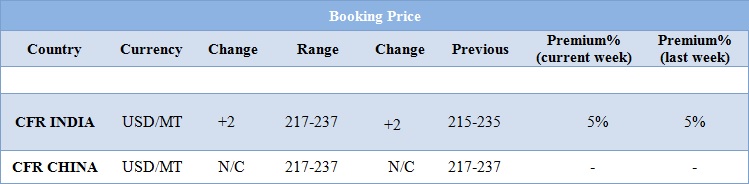

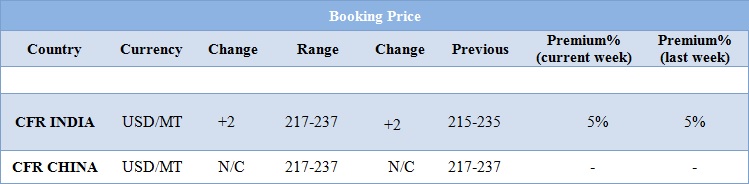

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol remained vulnerable and there was slight slowdown in prices in the starting of week itself. Prices in the domestic market reduced slightly for this week and were assessed at the level of Rs.17.75/Kg for bulk quantity.

- CFR India prices were assessed around USD 227/MTS, improved by USD 2/MT for this week.

- CFR China prices were assessed around USD 217-237/MT, with no change in values in compare to last week’s closing values for this week.

- China is celebrating its Golden week festival next week. So most of Chinese markets are not available and will resume work from next week.

- There has been rise in crude prices on back of building on gains in the previous session, after producer club OPEC hinted at making deeper cuts in supply while optimism was revived over talks between the United States and China to end their trade war.

- On Thursday Mohammad Barkindo, Secretary-General of the Organization of the Petroleum Exporting Countries (OPEC), said all options were on the table, including a deeper supply cut to balance oil markets. A decision would be taken at a December meeting between the OPEC and its partners, he said.

- OPEC lowered its 2019 global oil demand growth forecast to 0.98 million barrels per day (bpd), while leaving its 2020 demand growth estimate unchanged at 1.08 million bpd, according to OPEC's monthly report

- Beyond OPEC, trade talks between the United States and China also remained on market radar as the world's top two economies seek to resolve a more-than-a-year-long trade row that has slowed global economic growth and curbed fuel consumption.

- On Thursday, closing crude values have increased. WTI on NYME closed at $53.55/bbl. Prices have increased by 0.96/bbl in compared to last closing prices. While Brent on Inter Continental Exchange is increased by 0.78/bbl in compare to last closing price and was assessed around $59.10/bbl

MTO unit restarted by Shenhua Coal Co

- Shenhua Coal to Liquid and Chemical Co has restarted its Methanol-to-Olefins unit after brief maintenance. Earlier the unit was shut down in the month of July for an annual maintenance. The unit has restarted its production in last week. Unit is based at Yulin in Shaanxi in China and has the production capacity of ethylene around 300,000 mt/year and propylene capacity of 300,000 mt/year.

MTO unit restarted by Shandong Yangmei Hengtong Chemical

- Shandong Yangmei Hengtong Chemical has restarted its Methanol-to-Olefins unit after brief maintenance period. Earlier the unit was shut down in the month of July for an annual maintenance schedule. Unit has resumed its production in last month.

- Unit is based at Shandong province of China and has the production capacity of ethylene production capacity of 120,000 mt/year and propylene capacity of 180,000 mt/year.

$1 = Rs. 71.02

Import Custom Ex. Rate USD/ INR: 72.15

Export Custom Ex. Rate USD/ INR: 70.45