Methanol Weekly Report 11 March 2017

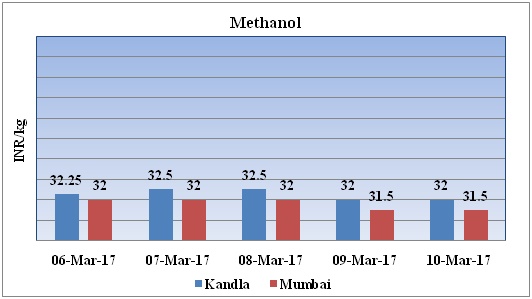

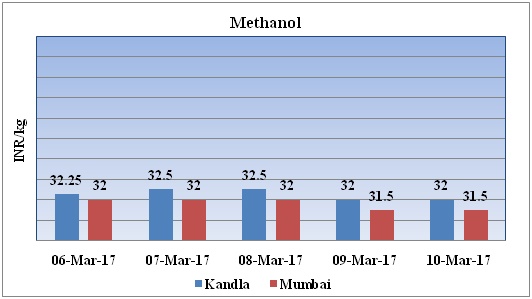

Weekly Price Trend: 06-03-2017 to 10-03-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.32/Kg for Kandla and Rs 31.5/kg Mumbai ports.

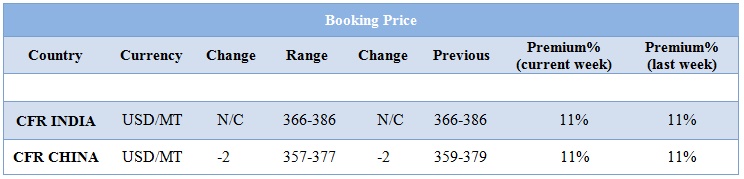

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 32/kg for Kandla and Rs 31.5/kg for Mumbai ports.

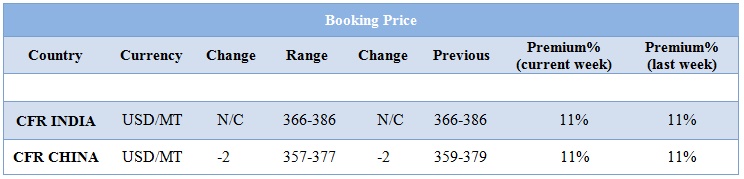

- CFR India prices were assessed in the range of USD 366-386/MTS. Prices have remained firm in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 405/mt.

- CFR China prices were assessed in the range of USD 357-377/MT prices have decreased in compares to previous week.

- Recently methanol market is moving with weak velocity market players have been uncertain for upcoming market outlook.

- In china, methanol prices also have plunged on account of oversupplied market. Product inventory is quite high in some methanol production plants.

- As per source related to methanol market from the mod of this month methanol supply is anticipated to plunge in the upcoming spring turnaround season in Northwest China.

- In Northwest China around 2.7 million mt/year of methanol capacity is involved, therefore traders will buy if the price is still on the low side in the anticipation of price will go up in near term turnaround.

- As per report downstream plants operating rate is anticipated to go up which will improve the demand.

- Market analyst predicting that in near term after festive season with the increase of downstream operating rate and heavy turnaround in Northwest China methanol market will be optimistic.

- China based Yulin Petrochemcial has reduced its operating rates at its Methanol plant. The operating rate has been reduced to its half on 6 March 2017. The unit will resume to its full operational capacity after two weeks. Unit is based at North west region of China and has the production capacity of 6,00,000 mt/year.

- This week oil prices have tumbled. In five days duration US oil prices have plunged around 7.5% while Brent oil have decreased 6.6% as record U.S. crude inventories fed doubts about whether OPEC-led supply cuts would reduce a global glut.

- As per report, declining oil prices have helped U.S. and global energy companies get back into the investing but analyst said that there's not enough money going into longer-term projects and if things don't change, oil prices could spike and supply could be short.

- Market players anticipate that OECD oil stocks to decline significantly this year helped by the large OPEC cuts and robust global demand growth, to consider the recent drop in crude oil prices to be a good opportunity to enter into bullish option structures.

$1 = Rs. 66.60

Import Custom Ex. Rate USD/ INR: 67.65

Export Custom Ex. Rate USD/ INR: 66.00