Methanol Weekly Report 07 Oct 2017

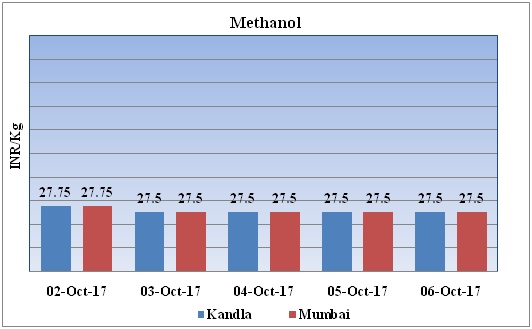

Weekly Price Trend: 02-10-2017 to 06-10-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.27.5/Kg for Kandla and Rs 27.5/kg Mumbai ports.

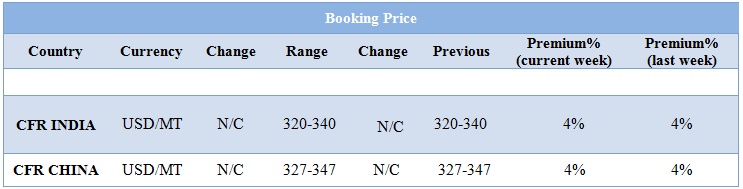

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 27.5/kg for Kandla and Rs 27.5/kg for Mumbai ports.

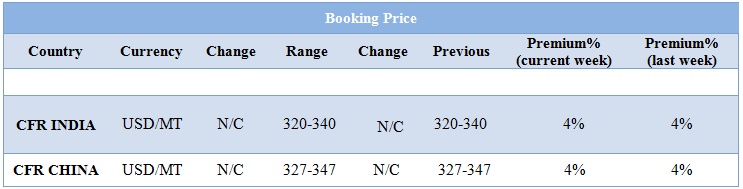

- CFR India prices were assessed in the range of USD 320-340/MTS. Prices have remained firm in compares to previous week.

- This week in China market have remained shut on account of golden week holiday.

- Methanol discounts 'on the rise' as long Europe market on the horizon.

- This week methanol market has remained soft-to-stable as no major trade deals have been heard.

- Kaltim Methanol Industri is planning to shut its methanol unit for maintenance turnaround. The unit is likely to go off-stream in the month of October as per annual maintenance schedule. Unit is expected to remain out of production for around 40 days and may resume its production n in November. Unit is based at Botang in Indonesia and has the production capacity of 6,60,000 mt/year.

- Brunei Methanol Company is planning to shut its Methanol unit for maintenance turnaround. The unit is likely to go off-stream in the last week of September 2017. The unit is likely to resume its production after 40-45 days. Unit is based in Brunei and has the production capacity of 850 Kt/year.

- This week oil prices have followed volatile trend. On Wednesday after slipping a bit oil prices rose on thurdsay on expectations that Saudi Arabia and Russia would extend production cuts, although record U.S. exports and the return of supply from a Libyan oilfield dragged on the market.

- On Thursday, closing crude values have increased.WTI on NYME closed at $50.79/bbl, prices have increased by $0.81/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $1.20/bbl in compared to last trading and was assessed around $57.00/bbl.

- As per market players, OPEC and other producers, including Russia, to cut oil output to boost prices could be extended to the end of 2018, instead of expiring in March 2018.

$1 = Rs. 65.38

Import Custom Ex. Rate USD/ INR: 65.95

Export Custom Ex. Rate USD/ INR: 64.30