Methanol Weekly Report 04 March 2017

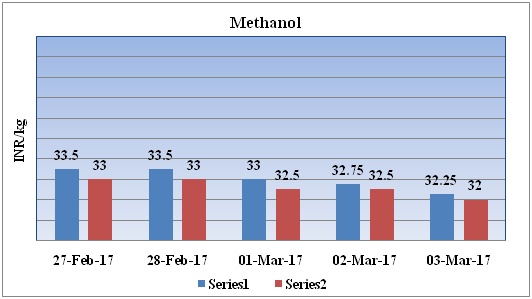

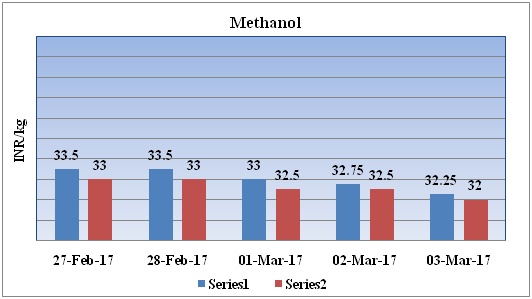

Weekly Price Trend: 27-02-2017 to 03-03-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.32.25/Kg for Kandla and Rs 32/kg Mumbai ports.

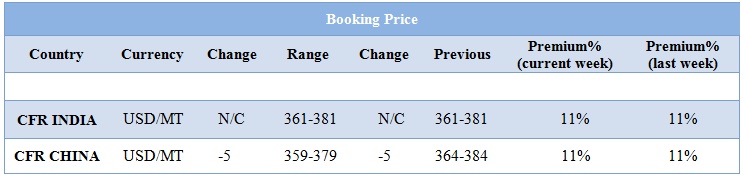

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 32.25/kg for Kandla and Rs 32/kg for Mumbai ports.

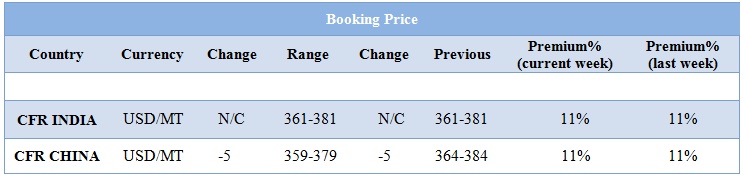

- CFR India prices were assessed in the range of USD 361-381/MTS. Prices have remained firm in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 386/mt.

- CFR China prices were assessed in the range of USD 359-379/MT prices have decreased in compares to previous week.

- Presently China methanol market is moving with uncertain velocity market players were anticipating that prices will boost but unfortunately china methanol prices is going down day by day.

- As per report China methanol imports have increased over the past three years. Many analysts and market participants believe that the cause behind the methanol imports recording historical high is that the expansion of MTO capacity outpaces that of methanol capacity.

- Some analyst says that China's methanol capacity expansion will not meet the faster growth of requirement from MTO industry, which is opportunity for imports.

- Near term methanol market is expected to move downward due to weak demand and good amount of material.

- The central government will soon come out with policies on the second generation ethanol, methanol and other non-conventional resources. It will further help to reduce the crude import bill by Rs. 1 lakh crore.

- Report said in view of surplus coal production it has been decided to promote methanol output and Petroleum Ministry will also bring a policy for production of methanol from coal.

- Oil prices have followed fluctuating trend during the week. Oil prices headed lower on Thursday to log their lowest finish in about three weeks, as U.S. government data showed that domestic crude inventories hit a record and production edged higher last week.

- As per market source the high crude stockpile levels in the U.S. is the number one reason behind oil’s recent inability to climb. On Friday oil prices jump as he United States imposed sanctions on some Iranian individuals and entities.

- The increasing U.S. crude output in recent months has largely offset the continuing production cuts by the OPEC and Russia are keeping prices in a slim range, said by analysts.

- Market predictors anticipating that the respite to continue for more weeks with the next major price mover likely to be OPEC’s meeting at the end of May in which members will decide whether to extend the cuts beyond the initial six-month period.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $52.61/bbl, prices have decreased by $1.22/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.28/bbl in compared to last trading and was assessed around $55.08/bbl.

$1 = Rs. 66.81

Import Custom Ex. Rate USD/ INR: 67.65

Export Custom Ex. Rate USD/ INR: 66.00