Methanol Weekly Report 02 Dec 2017

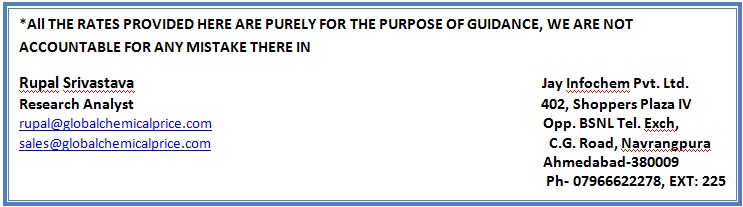

Weekly Price Trend: 27-11-2017 to 01-12-2017

The above graph focuses on the Methanol price trend for the current week. Prices have remained volatile for this week. By the end of the week prices were assessed around Rs28.25/Kg for Kandla and Rs 28.25/kg Mumbai ports.

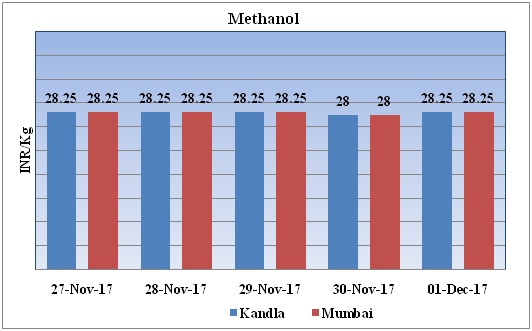

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed volatile trend and by the end of the week prices were evaluated at Rs 28.25/kg for Kandla and Rs 28.25/kg for Mumbai ports.

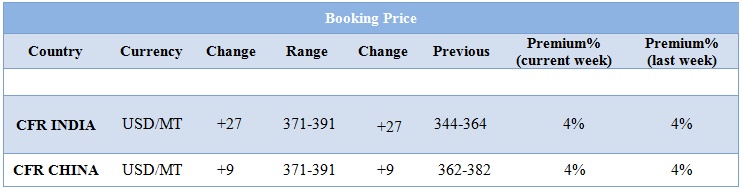

- CFR India prices were assessed in the range of USD 371-391/MTS. Prices have increased in compares to previous week.

- Methanol market is moving with up velocity. Demand sentiments have been increasing from end users.

- US methanol barge prices have been rising this week.

- China’s Shandong Mingshui Group raises its methanol offer by CNY30/tone as per report.

- Methanol may steady in south Shandong, China, after recent plunge.

- With the beginning of the month November domestic methanol prices has started upward move. On 1st nov methanol prices were evaluated around Rs 23.5 for Kandla and Mumbai ports of India and on 28th Nov prices were assessed at Rs 28.25/kg during one month period around 20% prices have increased.

- Methanol booking prices also have increased, in the first week of November CFR India methanol prices were evaluated in the range of USD 295-315/mt while in the last week methanol prices have increased by USD 50 and were valued in the range at USD 344-364/mt.

- As per market players, the reason behind methanol prices has escalated on shortage of supply and bullish demand sentiments from end users.

- In china market prices have escalated as in the end of October Yangmei Hengtong’s MTO plant resumed feedstock methanol procurement. Meanwhile, from other downstream plants also demand has increased resulted methanol prices shoot up.

- Higher freight cost also one of the reasons in China demand reinforced in Shandong, the logistics of moving products to restock the market became sluggish. Moreover, the freight cost to transport methanol areas like Shandong region has amplified which has spiral the prices.

- As per market participants recently methanol prices have swelled on lesser supply and good demand situation. In China production restrain on account of environmental protection and provide tentative opportunities for market players. For near term it is anticipated that methanol market will settle down from uptrend as several methanol production plants are again coming back to resume production after maintenance which will patch up supply demand imbalance.

- Canada based Methanex has announced its ACPC for the month of December 2017. It has increased its contract prices for the month October by USD 30/MTS. Asian Contract prices are posted at USD 430/MTS. Prices posted for the region of Europe around Euro 330/MT.

- SOCAR Methanol LLC has decided to reduce its supplies of methanol to international market. The country will focus more on domestic supplies. At present only 5% of production was supplied for domestic purpose remaining 95% was directed for international supplies.

- Production at Azerbaijan’s methanol plant, the only plant of this kind in the South Caucasus and Central Asia, started in January 2014.

- The plant’s annual capacity is 650,000-700,000 tons. SOCAR acquired the plant from the Aqrarkredit non-bank credit organization.

$1 = Rs. 64.46

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50