MEG Weekly Report 27 May 2017

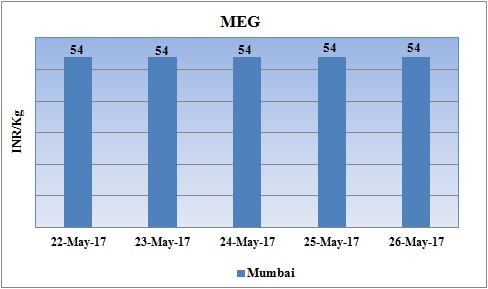

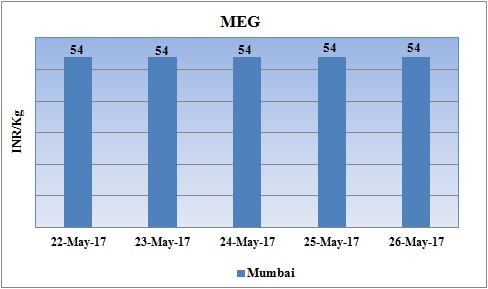

Weekly Price Trend: 22-05-2017 to 26-05-2017

- The above given graph focuses on the MEG price trend from 22nd May to 26th May 2017.

- Prices remained soft-to-stable for this week. Domestic prices were assessed at the level of Rs.54/Kg for bulk quantity with no change in compare to last week’s closing values.

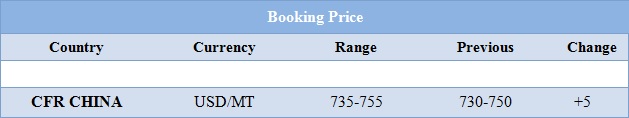

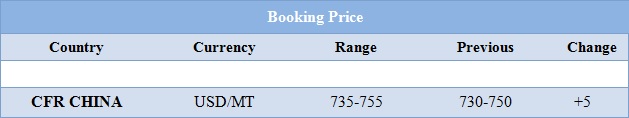

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained stable for this week. Prices were assessed at the level of Rs.54/Kg for bulk quantity.

- CFR India prices were assessed in the range of USD 740-750/MTS. Prices increased heavily for this week.

- CFR China values increased by USD 5/MTS in compare to last week’s assessed values and were assessed in the range of USD 735-755/MT

- CFR SEA prices for MEG were assessed around USD 750/MT for this week. FOB Korea values for Ethylene was assessed around USD 1060/MTS while CFR China values for Ethylene were assessed around USD 1105/MTS.

- FOB Korea values for Propylene was assessed around USD 860/MTS while CFR China values were assessed around USD 895/MTS.

- This week oil prices remained highly volatile. On Thursday, Crude oil prices plunged more than 5 percent below $49 per barrel, its biggest daily drop in last three weeks as OPEC members agreed to extend oil output cuts for nine months, crude oil traders pushed prices down by more than 4%.

- As per report, OPEC and some non-OPEC members agreed to extend oil supply cuts of 1.8 million barrels per day for a further nine months in a bid to stop waving prices. However, the move disappointed some who had hoped for longer or deeper cuts.

- As per market analyst, an initial six months of output reductions failed to shrink brimming crude stockpiles around the world. OPEC members need to curtail exports and take action to limit surging U.S. production to succeed this time.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $48.90/bbl, prices have decreased by $2.46/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $2.50/bbl in compared to last trading and was assessed around $51.46/bbl

$1 = Rs. 64.44

Import Custom Ex. Rate USD/ INR: 65.30

Export Custom Ex. Rate USD/ INR: 63.60