MEG Weekly Report 23 Sep 2017

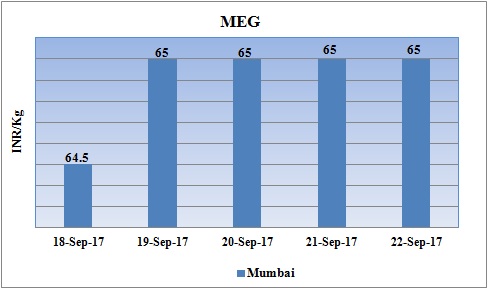

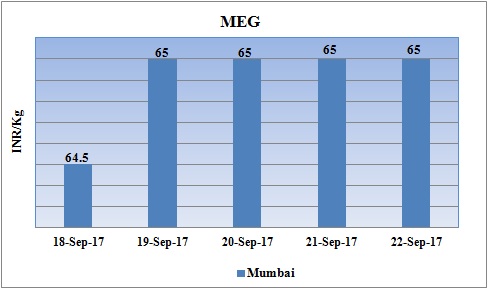

Weekly Price Trend: 18-09-2017 to 22-09-2017

- The above given graph focuses on the MEG price trend from 18th Sept to 22nd Sept 2017.

- Prices increased significantly for this week. Domestic prices were assessed at the level of Rs.65/Kg for bulk quantity, remained unchanged for bulk quantity in compare to last week’s closing values.

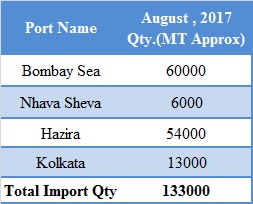

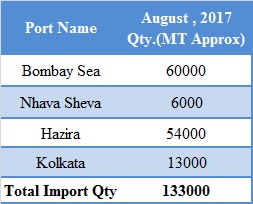

Total import at various ports in the month of August 2017

The above chart depicts the import of MEG at various ports of India in the month of August 2017.

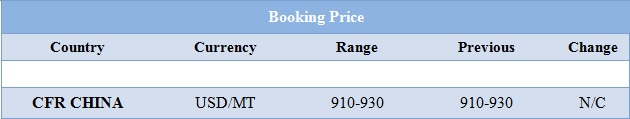

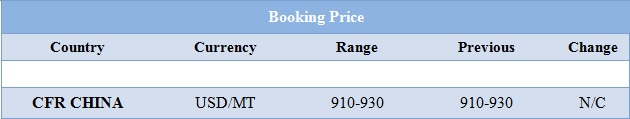

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices witnessed a rise in values. Prices were assessed at the level of Rs.65/Kg for bulk quantity.

- CFR China values were assessed around USD 910-930/MT with no change in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1290/MT while FOB Korea values were assessed around USD 1245/MT.

- This week there has been significant hike in crude values. Prices has reached too its highest level since April in this year. Crude values rose above $ 50/barrel for the first time. Both the contracts have increased by more than 19% since /June.

- This week oil prices followed mixed trend. Oil prices were steady on Thursday ahead of a meeting of oil producers that could extend production limits aimed at clearing a glut that has depressed the market for more than three years. As per report, Ministers from the OPEC, Russia and other producers meet in Vienna on Friday and are due to consider extending output cuts that began in January.

- On Thursday, closing crude values have mixed.WTI on NYME closed at $50.55/bbl, prices have decreased by $0.14/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.14/bbl in compared to last trading and was assessed around $56.43/bbl. Presently many analysts anticipate that OPEC to extend the deal, possibly to the end of next year

$1 = Rs. 64.79

Import Custom Ex. Rate USD/ INR: 65.40

Export Custom Ex. Rate USD/ INR: 63.70