MEG Weekly Report 23 Dec 2017

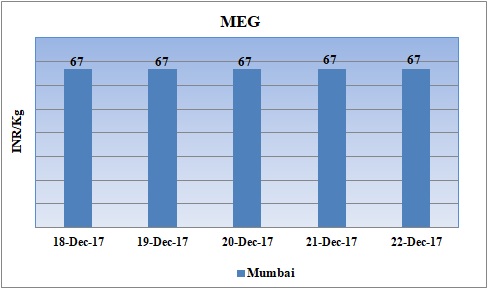

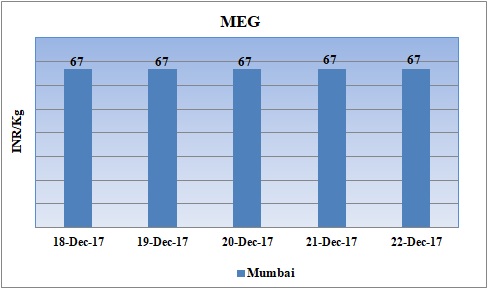

Weekly Price Trend: 18-12-2017 to 22-12-2017

- The above given graph focuses on the MEG price trend from 18th Dec to 22nd Dec 2017.

- Prices remained unchanged for this week. Domestic prices were assessed at the level of Rs.67/Kg for bulk quantity.

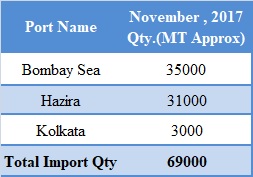

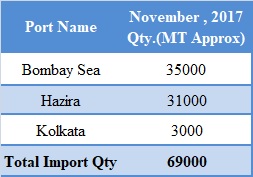

Total import at various ports in the month of November 2017

The above chart depicts the import of MEG at various ports of India in the month of November 2017.

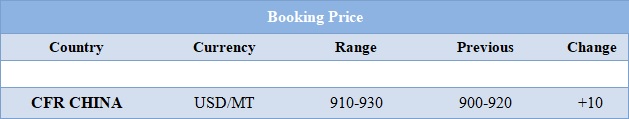

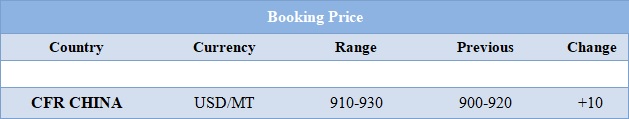

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONALs

- This week domestic prices remained stable for bulk quantity. Prices were assessed at the level of Rs.67/Kg for bulk quantity.

- CFR China values were assessed around USD 910-9300MT, slightly increased by USD 10/MTS in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1335/MT while FOB Korea values were assessed around USD 1305/MT.

- CFR China Propylene values were assessed around USD 990/MT while FOB Korea values were assessed around USD 930/MT.

- Ethylene values have remained firm since last few weeks. Prices are expected to continue with this firmness for next few weeks as well.

- Strong buying sentiments coupled with healthy demand has been dominating the Asian markets for price surge.

- Propylene market has also been witnessing firmness in prices. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian markets.

- The initial offers for 2018 for Ethylene have been offered with premium of USD 30-35/MT. Hike in premium is basically due to limited supply in the region, specially from Japan. Many crackers are scheduled for maintenance in the firs quarter of 2018 in Japan in turn leading to limited supply.

- Similar scenario is observed in Middle East as well. The supplies from Saudi will reduced as new ethylene downstream plant will start soon in the region. In 2017, Saudi Arabia's ethylene exports increased due to a delay in the start of a new local polyethylene plant. This is the reason why Ethylene is offered at very high premium.

- This week oil prices have followed mixed trend and closed on higher note. On Thursday, Oil prices higher, erasing earlier losses as Britain's Forties pipeline in the North Sea was expected to restart in early January after repairs over Christmas. Forties is the largest of the five North Sea crudes that underpin Brent, a benchmark for oil trading in Europe, the Middle East, Africa and Asia.

- On Thursday, closing crude values have increased. WTI on NYME closed at $58.36/bbl; prices have increased by $0.27/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.34/bbl in compared to last trading and was assessed around $64.90/bbl.

- As per market report, based on current estimates the company expects to bring the pipeline progressively back to normal rates early in the new year. Oil prices were also supported by falling crude inventories in the United States but capped by output that is fast approaching 10 million barrels per day.

- As me market predictors said that the first few months of 2018 to be either flat or a build in inventories, as it is typically the case with the seasonality in the oil market.

$1 = Rs. 64.04

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.20