MEG Weekly Report 22 Sep 2018

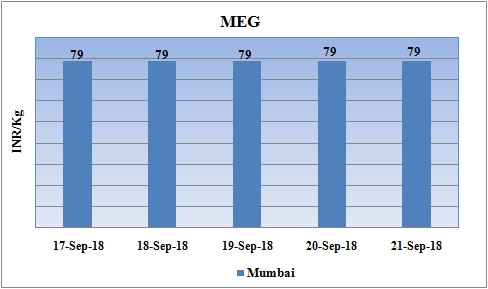

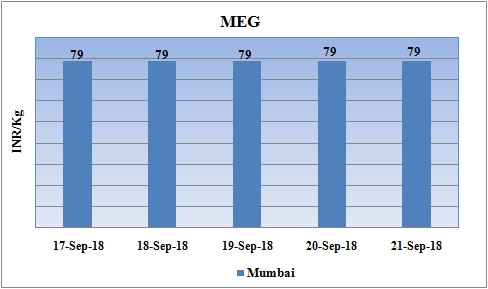

Weekly Price Trend: 17-09-2018 to 21-09-2018

- The above given graph focuses on the MEG price trend from 17th Sept to 21st Sept 2018.

- Domestic prices surged up in the starting of week itself. Prices remained stable-to-firm for rest of the week. Domestic prices were assessed at the level of Rs.79/Kg for bulk quantity.

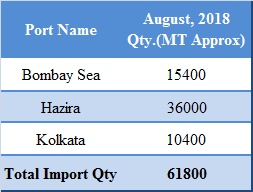

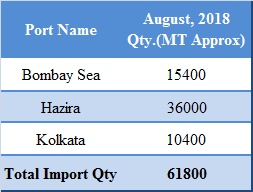

Total MEG imports in the month of August 2018

The above chart depicts the total import of MEG in the month of august 2018

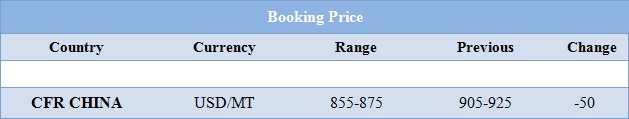

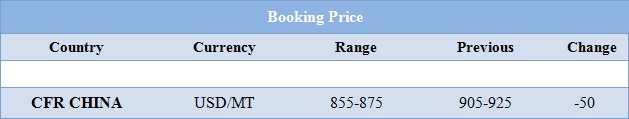

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained stable for bulk quantity. Prices were assessed at the level of Rs.79/Kg for bulk quantity.

- CFR China values were assessed around USD 855-875/MT, reduced by USD 50/MTS for this week. CFR South East Asia assessed around USD 890/MT.

- CFR India price were assessed around USD 890/MT.

- FOB Korea values for Ethylene reduced heavily and were assessed around USD 1270/MT, while CFR China values were assessed around USD 1245/MT and CFR South East Asia values were assessed around USD 1125/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1125/MT while CFR China values were assessed around USD 1160/MT.

- In compare to MEG values prices for Ethylene and Propylene has reduced heavily in the international market.

- Traders are not in mood to keep stocks for next few weeks. They are in process of selling out their stockpiled material. The reason for this bullish sell is preparation for national holiday celebration of one week in the first week of October.

- Many other downstream factories in China are not operating at full rate as they are highly anxious that the trading disputes these environmental measures will continue to stay for long in the future.

- Oil prices crossed the levels of USD80 by mid of the week, later it fell by more than 2% on Thursday. This hike was the highest in last four months. The international Energy Agency has already warned that the oil market is tightening at the moment and world oil demand would soon reach 100 million barrels per day (bpd) in the next three months, global economic risks were mounting.

- U.S. companies in China are being hurt by tariffs in the growing trade war between Washington and Beijing, according to a survey, prompting U.S. business lobbies to urge President Donald Trump's administration to reconsider its approach.

- With imposition of US tariffs on China the impact will be hurting the economies of the Asian countries. The effect will come into existence on 24 of this month. Still international market is yet to digest this sanctions, the US government has come up with fresh set of tariffs. The current tariffs are 10% and will rise to 25% from 1st Jan 2019.

- China in response to July sanctions has already imposed tariffs on imports from US. They may plant to retaliate further with this new announcement.

- There are many chemical products which are included in the $200 bn list of tariffs. Benzene, Phenol, Toluene, Petroleum Oils, Ethylene ,Propylene, o xylene, mixed xylene, para xylene, styrene, cumene methanol are some of the crucial chemicals listed in this list.

- To retaliate back China will soon put forth its own lists of products. China has previously announced a 5%-25% tariffs on $60bn worth of US goods as its countermeasure to a further tariff action by the US. The US President has already announced it will impose tariffs on further $267bn worth of Chinese goods if China chose to retaliate again.

$1 = Rs. 72.19

Import Custom Ex. Rate USD/ INR: 73.65

Export Custom Ex. Rate USD/ INR: 71.95