MEG Weekly Report 21 April 2018

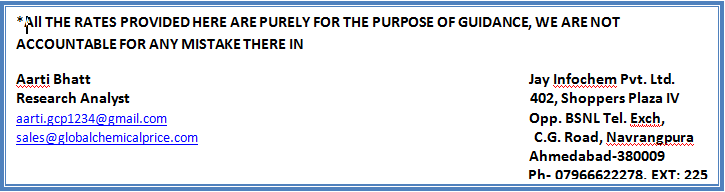

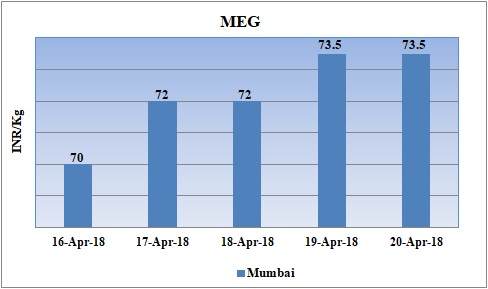

Weekly Price Trend: 16-04-2018 to 20-04-2018

- The above given graph focuses on the MEG price trend from 16th April to 20th April 2018.

- Prices remained head strong high for this week. Domestic prices were assessed at the level of Rs.73.5/Kg for bulk quantity.

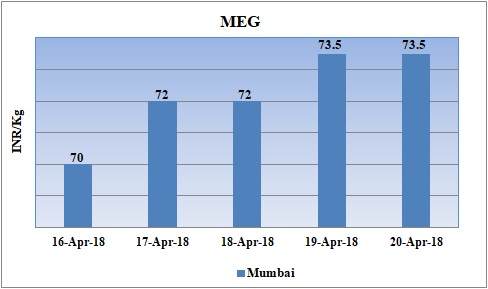

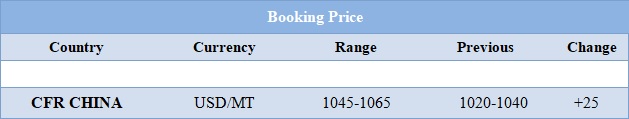

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained firm for bulk quantity. Prices were assessed at the level of Rs.73.5/Kg for bulk quantity.

- CFR China values were assessed around USD 1045-1065/MT, increased by USD 25/MT in one week. CFR South East Asia assessed around USD 1060/MT again increased by USD 25/MT in last one week.

- FOB Korea values for Ethylene were assessed around USD 1400/MT, increased by USD 15/MTS while CFR China values were assessed around USD 1365/MT, while CFR South East Asia values were assessed around USD 1280/MT.

- On other side Propylene market has also increased for this week. FOB Korea values were assessed around USD 1045/MT while CFR China values were assessed around USD 1080MT.

- After a significant hike in Asian market, the MEG values have been climbing high in European market. CFR China prices has been floating in the range of USD 1050-1070/MT. Prices for Europe market were assessed in the range of 800-820/MT Pounds, increased by 45 Pounds. Lower inventories with sudden hike in demand have been the pushing factor for this increase in values. MEG is mainly used in the production of resins,films and polyester fibres which is further used polyethylene terephthalate (PET) resin.

- The naphtha cracker has been shut down by Tosoh Corp for maintenance turnaround.

- The unit is expected to remain off-stream around 6 weeks. The cracker is based at Yokkaichi in Japan and has the manufacturing capacity of 5,27,000 mt/year.

- Mitsubishi Chemical is planning to shut its naphtha cracker for maintenance turnaround. The unit will go off-stream next month as per maintenance schedule. The unit is expected to remain off-line for around two months. Unit is based at Kashima in Japan and has the manufacturing capacity of Ethylene around 540,000 mt/year and a propylene capacity of 260,000 mt/year.

- Japanese company Showa Denka has shut down its cracker earlier in the first week of March. The unit was shut down for its maintenance program. Now the unit is expected to resume its production by end of this week. Unit is based at Oita in Japan and has the manufacturing capacity of Ethylene around 6,90,000 mt/year.

- The prices have seen a new height in crude sector since 2014 due to ongoing in global supply with Saudi Arabia intending for prices to still go high in the international market.

- The previous oversupply of crude is no more in the international market. Experts believe that reaching the marl of $ 70 is very near in the future.

- Oil prices have escalated through the week but on Thursday prices have remained mixed. On Thursday, closing crude values have decreased. WTI on NYME closed at $68.29/bbl; prices have decreased by $0.18/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.30/bbl in compared to last trading and was assessed around $73.78/bbl.

$1 = Rs. 66.03

Import Custom Ex. Rate USD/ INR: 66.70

Export Custom Ex. Rate USD/ INR: 65.00