MEG Weekly Report 20 Oct 2018

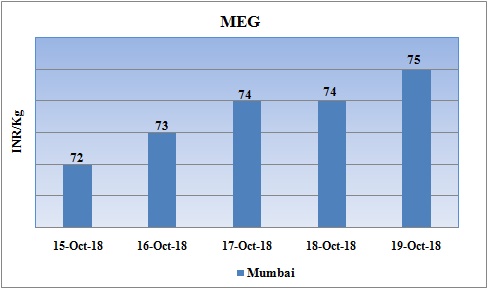

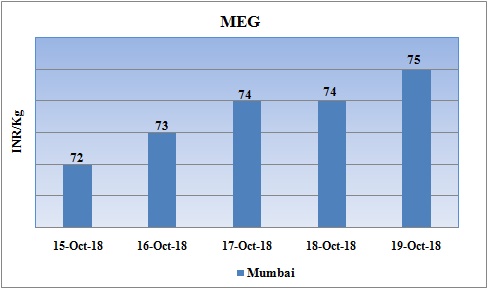

Weekly Price Trend: 15-10-2018 to 19-10-2018

- The above given graph focuses on the MEG price trend from 15th Oct to 19th Oct 2018.

- Domestic prices remained firm with rise in values for this week. Domestic prices were assessed at the level of Rs.75/Kg for bulk quantity.

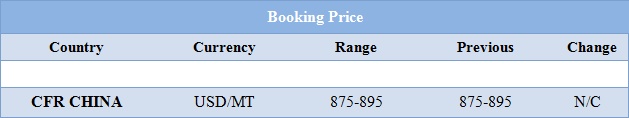

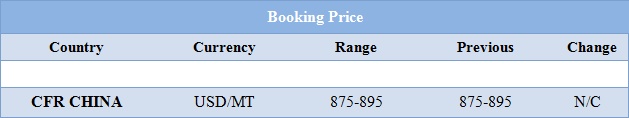

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained weak for bulk quantity. Prices were assessed at the level of Rs.75/Kg for bulk quantity.

- CFR China values were assessed around USD 870-890/MT, slightly reduced by USD 5/MT for this week. CFR South East Asia assessed around USD 895/MT. CFR India price were assessed around USD 900/MT.

- FOB Korea values for Ethylene improved for this week and were assessed around USD 1190/MT, while CFR China values were assessed around USD 1165/MT and CFR South East Asia values were assessed around USD 1065/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1135/MT while CFR China values were assessed around USD 1195/MT.

- In compare to MEG values prices for Ethylene and Propylene has reduced heavily in the international market.

- There has been significant decline in crude prices in last two weeks. Prices plunged by more than 11 % in last two weeks. Oil prices rose to nearly four-year highs at the start of October as there has been depletion in crude supply sue to US sanctions on Iran.

- Rising U.S. crude stockpiles, forecasts for slower-than-expected demand growth and a sell-off in stock markets have weighed on crude futures.

- The supply of oil held in U.S. storage tanks has risen sharply over the last four weeks. U.S. crude stockpiles are up by 22.3 million barrels through last week. That's the biggest increase over that four-week period since 2015, when storage levels were rising toward all-time highs in a heavily oversupplied market.

- The market remains uncertain about the ability of producers such as Saudi Arabia and Russia to fill the gap left by the loss of roughly 1 million barrels a day of Iranian exports. Analysts say the market is deeply cynical that Riyadh would cut output and push oil prices higher to settle a political score.

- Asahi Kasei has announced its maintenance schedule for its cracker unit for next year. The cracker will undergo maintenance in the month of May or June next year. The exact date and duration of the turnaround has not been specified yet by the company sources. Unit is based at Mizushima in Japan and has the production capacity of Ethylene around 5,70,000 mt/year.

$1 = Rs. 73.32

Import Custom Ex. Rate USD/ INR: 74.30

Export Custom Ex. Rate USD/ INR: 72.60