MEG Weekly Report 19 Aug 2017

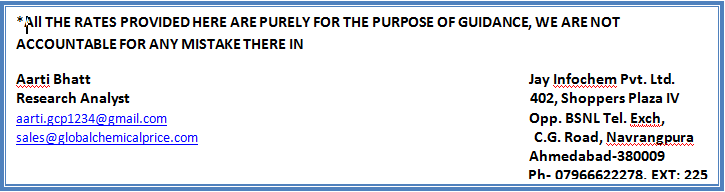

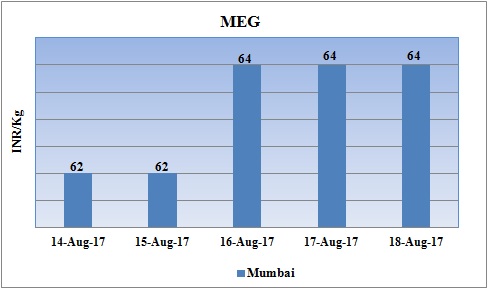

Weekly Price Trend: 14-08-2017 to 18-08-2017

- The above given graph focuses on the MEG price trend from 14th August to 18th August 2017.

- Prices increased significantly for this week. Domestic prices were assessed at the level of Rs.64/Kg for bulk quantity, with an increase of Rs.2/Kg for bulk quantity in compare to last week’s closing values.

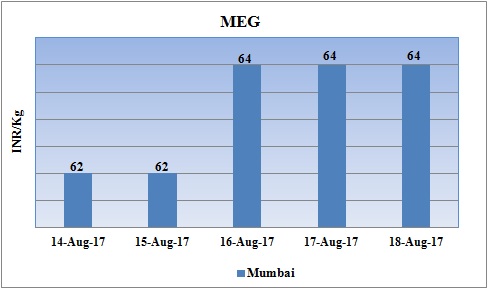

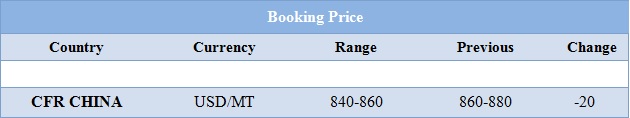

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices witnessed a rise in values. Prices were assessed at the level of Rs.64/Kg for bulk quantity.

- CFR China values were assessed around USD 840-860/MTS decreased by USD 20/MT in compare to last week’s assessed values.

- FOB Korea Ethylene values were assessed in the range of 1145-1165/MTS while CFR China values were assessed in the range of USD 1185-1200/MTS.

- There has been continuous oscillation in crude prices for this week. On Thursday oil prices rose as renewed attention was put on U.S. oil stockpile declines at Cushing, the delivery hub for U.S. crude futures.

- On Thursday, closing crude values have increased.WTI on NYME closed at $47.09/bbl, prices have increased by $0.31/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.76/bbl in compared to last trading and was assessed around $51.03/bbl.

- Market players further anticipate that crude oil prices are likely to trade sideways on the back of short covering after drop in prices. As per market predictors, the oil market has experienced a high level of disruptions to crude supply in recent years. Prices could spike above $70 a barrel if recently restored production in Nigeria and Libya falls again. But it could also sink below $40 if disruptions elsewhere in the world get resolved, putting more crude oil into the market.

- Moreover, OPEC reported its production continued to rise despite its supply quota deal with Russia. Analysts remain unconvinced that OPEC can re-balance the global oil markets without full participation from all cartel members.

$1 = Rs. 64.14

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.45