MEG Weekly Report 16 Dec 2017

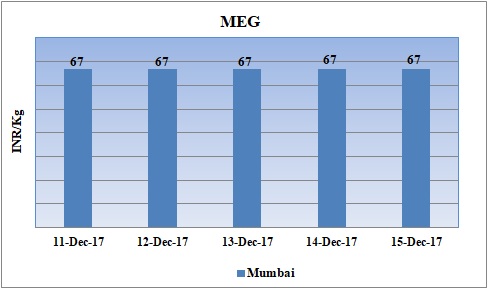

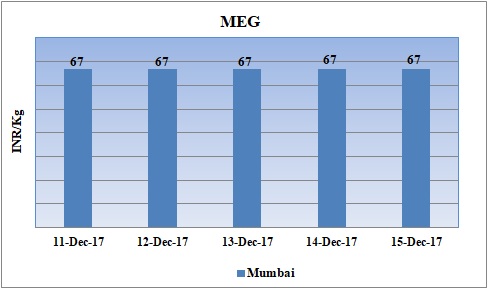

Weekly Price Trend: 11-12-2017 to 15-12-2017

- The above given graph focuses on the MEG price trend from 11th Dec to 15th Dec 2017.

- Prices remained unchanged for this week. Domestic prices were assessed at the level of Rs.67/Kg for bulk quantity.

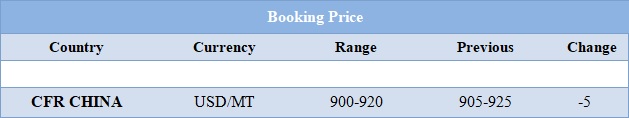

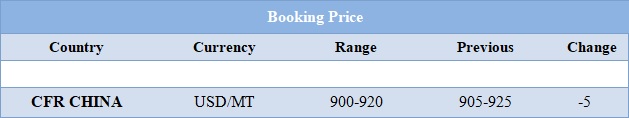

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONALs

- This week domestic prices remained stable for bulk quantity. Prices were assessed at the level of Rs.67/Kg for bulk quantity.

- CFR China values were assessed around USD 900-9200MT, slightly reduced by USD 5/MT in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1300/MT while FOB Korea values were assessed around USD 1255/MT.

- CFR China Propylene values were assessed around USD 980/MT while FOB Korea values were assessed around USD 920/MT.

- Sanjiang Chemical will shut down its MEG unit for maintenance in June 2018. Earlier the company has plans to call off the production December end of 2017. But now the shutdown has been postponed to June 2018. China based unit has the production capacity of 150 Kt/year.

- Sharq has restarted its MEG unit 4. Earlier the unit was shut down for annual maintenance program. Another MEG unit based in China owned by Kayan will go on-stream very soon.

- This week crude oil prices have followed mixed trend. On Thursday oil prices rose as a pipeline outage in Britain continued to support prices despite forecasts showing global crude surplus in the beginning of next year.

- On Thursday, closing crude values have increased. WTI on NYME closed at $57.04/bbl; prices have increased by $0.44/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.87/bbl in compared to last trading and was assessed around $63.31/bbl.

- While on Friday, Oil markets were stable as the Forties pipeline outage in the North Sea and the ongoing OPEC-led production cuts supported prices, while rising output from the United States kept crude from rising further.

- Traders said markets were overall well supported by efforts led by OPEC and Russia to withhold supply to prop up prices.

- As per market report, the oil market to have a surplus of 200,000 barrels per day in the first half of next year before reverting to a deficit of about 200,000 bpd in the second half. That means 2018 overall should show closely balanced market.

$1 = Rs. 64.04

Import Custom Ex. Rate USD/ INR: 65.40

Export Custom Ex. Rate USD/ INR: 63.70