MEG Weekly Report 15 Sep 2018

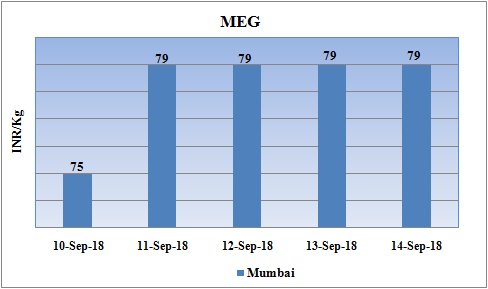

Weekly Price Trend: 10-09-2018 to 14-09-2018

- The above given graph focuses on the MEG price trend from 10th Sept to 14th Sept 2018.

- Domestic prices surged up in the starting of week itself. Prices remained stable-to-firm for rest of the week. Domestic prices were assessed at the level of Rs.79/Kg for bulk quantity.

Booking Scenario

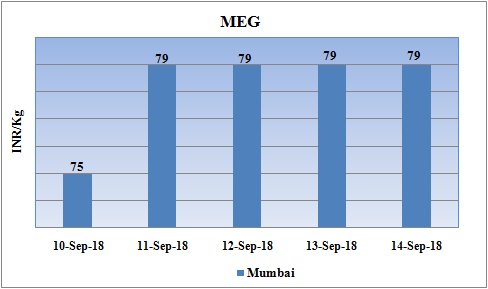

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained vulnerable for bulk quantity. Prices were assessed at the level of Rs.74/Kg for bulk quantity.

- CFR China values were assessed around USD 905-925/MT, reduced by USD 70/MTS for this week. CFR South East Asia assessed around USD 935/MT.

- FOB Korea values for Ethylene reduced heavily and were assessed around USD 1345/MT, while CFR China values were assessed around USD 1305/MT and CFR South East Asia values were assessed around USD 1295/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1105/MT while CFR China values were assessed around USD 1145/MT.

- In compare to MEG values prices for Ethylene and Propylene has reduced heavily in the international market.

- Traders are not in mood to keep stocks for next few weeks. They are in process of selling out their stockpiled material. The reason for this bullish sell is preparation for national holiday celebration of one week in the first week of October.

- Many other downstream factories in China are not operating at full rate as they are highly anxious that the trading disputes these environmental measures will continue to stay for long in the future.

- Oil prices crossed the levels of USD80 by mid of the week, later it fell by more than 2% on Thursday. This hike was the highest in last four months. The international Energy Agency has already warned that the oil market is tightening at the moment and world oil demand would soon reach 100 million barrels per day (bpd) in the next three months, global economic risks were mounting.

- U.S. companies in China are being hurt by tariffs in the growing trade war between Washington and Beijing, according to a survey, prompting U.S. business lobbies to urge President Donald Trump's administration to reconsider its approach.

- The White House has invited Chinese officials to restart trade talks just as it prepares to escalate a trade war with China with tariffs on $200 billion worth of Chinese goods.

- The other major factor is the loss of Iranian oil to the market as refiners are cutting or halting purchase ahead of U.S. sanctions in November is also raising concerns about supply.

- All these factor has put an rigorous pressure on petrochemical industry and has led to hike in the prices of crucial petrochemical products.

$1 = Rs. 71.84

Import Custom Ex. Rate USD/ INR: 72.55

Export Custom Ex. Rate USD/ INR: 70.85