MEG Weekly Report 10 Feb 2018

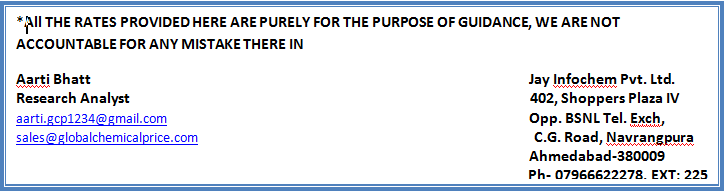

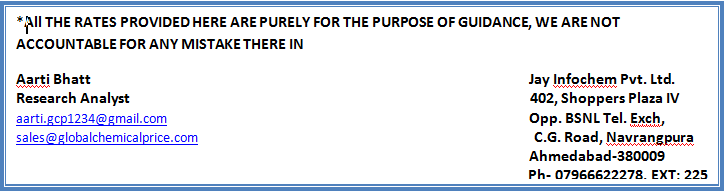

Weekly Price Trend: 05-02-2018 to 09-02-2018

- The above given graph focuses on the MEG price trend from 5th Feb to 9th Feb 2018.

- Prices increased for this week on back of abundant supply in domestic market. Domestic prices were assessed at the level of Rs.73/Kg for bulk quantity.

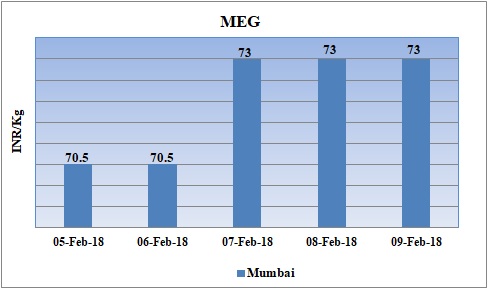

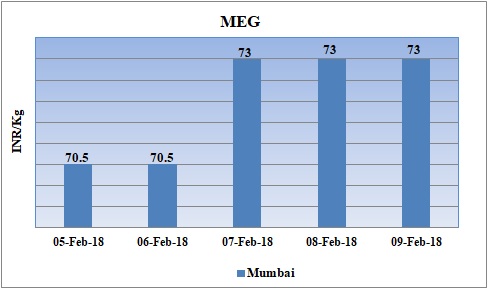

Total import of MEG in the year 2017

The above chart depicts the total imports of MEG month wise for the year 2017. On an average 75000-76000 MT has been the imports every month in the country.

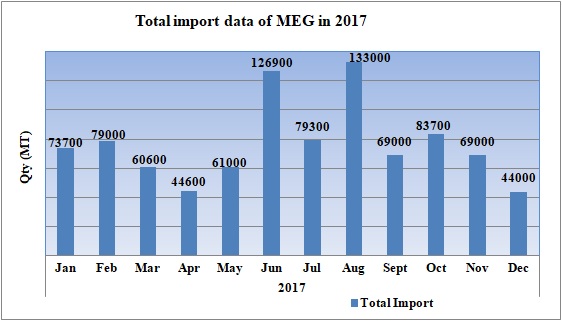

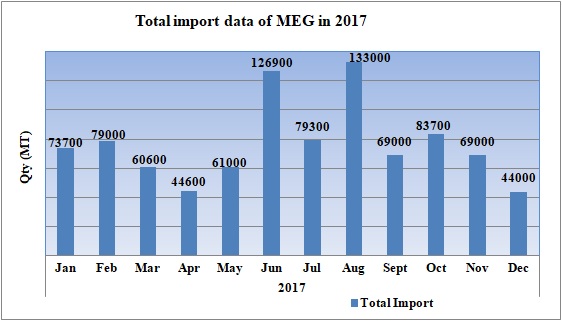

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained stable-to-firm for bulk quantity. Prices were assessed at the level of Rs.73/Kg for bulk quantity.

- CFR China values were assessed around USD 1015-1035MT, with an increase of USD 10/MTS in compare to last week’s assessed values.

- CFR South East Asia assessed around USD 1030/MT increased by USD10/MTS in compare to last week’s closing values.

- FOB Korea values for Ethylene were assessed around USD 1285/MT, reduced by USD 20/MTS while CFR China values were assessed around USD 1315/MT, reduced by USD 20/MTS in compare to last week’s closing values.

- Hike in MEG values is now getting consolidated. Major polyester units in China has either cut down their operating rates or has shut down their units for Chinese Lunar holidays. Operating rates in major plants based at Zhejiang and Jiangsu were reduced by more than 45%. This operation rate will recover slowly by February end.

- In March, MEG production in China may increase on limited turnarounds and rising output of coal-based MEG. While demand for MEG is also expected to increase in March, with restarts of polyester units and scheduled startups of Hengbang's 300kt/year, Jiaxing Petrochemical's 300kta, Xinfengming's 300kt/year, and the restart of Hongjian's unit.

- Market experts are still under confusion about the improvement in condition after Lunar holidays. Its better to adopt the wait and watch stand.

- Propylene market has also been witnessing firmness in prices. FOB Korea values were assessed around USD 1070/MT while CFR China values were assessed around USD 1140MT. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian markets.

- There has been increase in domestic values along with hike in international prices. But this hike was subdued as week progressed. In the latter half of the week there has been heavy decline in crude values which in turn led to slight weakening of other petrochemical products.

- This week crude oil prices have followed weak trend. Oil prices fell sharply after the U.S. government reported crude stockpiles rose by 1.9 million barrels. The increasing U.S. oil production and crude stockpiles, and stock market sell-off, piled pressure on oil prices this week. A stronger dollar has also been a prevailing factor the decline. But the supply dynamics are working against a sustained price rally.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $61.15/bbl; prices have decreased by $0.64/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.70/bbl in compared to last trading and was assessed around $64.81/bbl.

- As per market analyst oil market moves could be exaggerated because the number of bets that crude prices will keep climbing has risen sharply, while wagers that prices will fall have plunged. That extreme market positioning can encourage bouts of profit-taking.

$1 = Rs. 64.40

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.85