MEG Weekly Report 10 Aug 2018

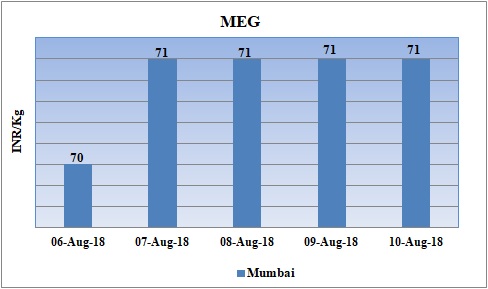

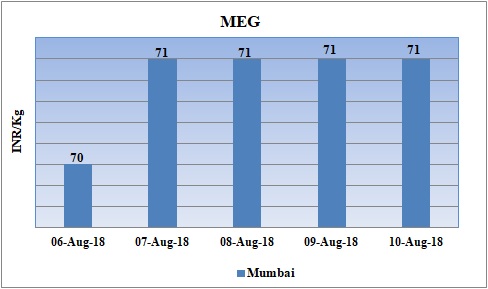

Weekly Price Trend: 06-08-2018 to 10-08-2018

- The above given graph focuses on the MEG price trend from 6th July to 3rd August 2018.

- Prices remained stable-to-firm for this week. Domestic prices were assessed at the level of Rs.71/Kg for bulk quantity.

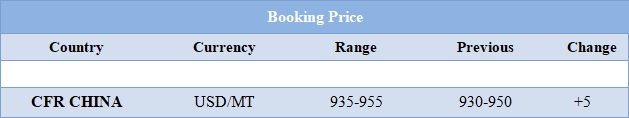

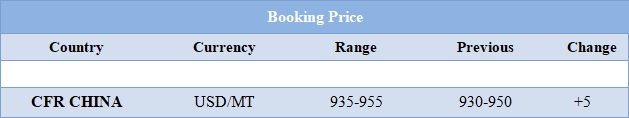

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained firm for bulk quantity. Prices were assessed at the level of Rs.71 /Kg for bulk quantity.

- CFR China values were assessed around USD 935-955/MT, increased by USD 5/MT for this week. CFR South East Asia assessed around USD 975/MT.

- FOB Korea values for Ethylene were assessed around USD 1340MT, while CFR China values were assessed around USD 1395/MT and CFR South East Asia values were assessed around USD 1255/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1080/MT while CFR China values were assessed around USD 1115/MT.

- There has been significant hike in Ethylene and Propylene values in China market.

- After witnessing a dull session the Polyester industry has regained its charm in the Chinese domestic market. Demand of MEG from Polyester industry has increased by many folds in past few weeks. Further there has been consistent hike in upstream PTA values. The demand in domestic industry has pulled up the lifting of PTA and MEG. This in turn has led to significant decline in the inventory levels in the country.

- To support further MEG uptrend is the current market is the trade conflicts and tariffs war between US and China. This has led to heavy depreciation of Chinese currency against US dollar and China imports huge amount of MEG.

- This week oil prices have followed volatile trend. On Thursday Crude prices held near lower levels set in the previous session, as the escalating China-U.S. trade dispute cast doubt on the outlook for oil demand.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $66.81/bbl. Prices have decreased by $0.13/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.21/bbl in compare to last closing price and was assessed around $72.07/bbl. Both benchmarks tumbled more than 3 percent after U.S. data showed a smaller-than-expected weekly draw in crude inventories and a surprise build of 2.9 million barrels in gasoline supplies.

- As per report, despite the possibility of a slowdown in economic growth due to escalating trade tensions, oil markets are for now relatively tight, because of sanctions on Iranian oil exports the United States plans to implement in November. Beyond Iran sanctions, the escalating trade dispute between Washington and Beijing was weighing on global markets.

$1 = Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.25

Export Custom Ex. Rate USD/ INR: 67.55