MEG Weekly Report 09 June 2018

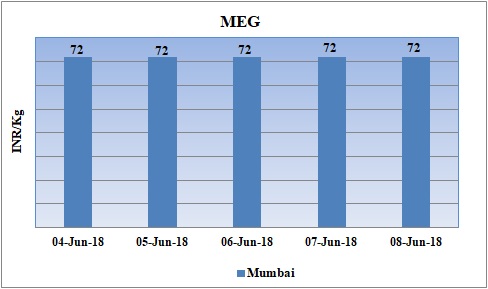

Weekly Price Trend: 04-06-2018 to 08-06-2018

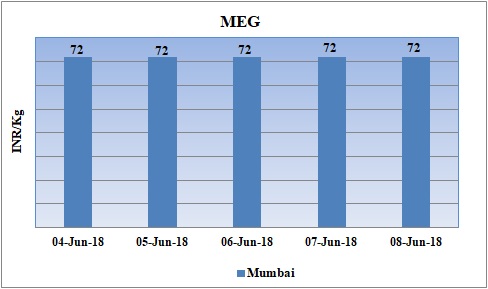

- The above given graph focuses on the MEG price trend from 4th June to 8th June 2018.

- Prices remained soft-to-stable for this week. Domestic prices were assessed at the level of Rs.72/Kg for bulk quantity.

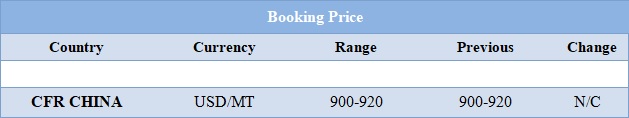

Booking Scenario

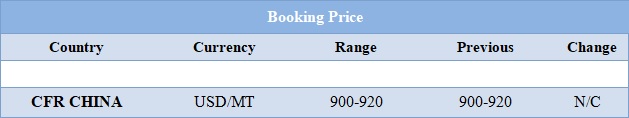

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained soft for bulk quantity. Prices were assessed at the level of Rs.72 /Kg for bulk quantity.

- CFR China values were assessed around USD 900-920/MT, remained unchanged for this week. CFR South East Asia assessed around USD 960/MT.

- FOB Korea values for Ethylene were assessed around USD 1275/MT, while CFR China values were assessed around USD 1335/MT and CFR South East Asia values were assessed around USD 1230/MT.

- On other side Propylene market remained stable for this week. FOB Korea values were assessed around USD 1085/MT while CFR China values were assessed around USD 1110MT.

- With dull regional buying sentiments along with bulk availability from regional sector and the last weak demand from polyester industry all together has led to price fall.

- MEG values in China market has been melting down past few weeks. PTA prices have also reduced due to weak demand from downstream industry. On contrary to this there has been consistent hike in PTA values in other markets due to regional shutdown and limited supply

- There has been wide gap between the import price for PTA and its domestic prices. As a result most of the consumers in China are focusing more towards local supply. The demand for PTA is likely to get soggier as traditionally the current season is regarded lull for polyester industry.

- This week oil prices have followed volatile trend. On Thursday oil prices surged due to concern about a steep drop in exports from Venezuela and concerns OPEC may not raise production at its meeting this month.

- On Thursday, closing crude values have increased. WTI on NYME closed at $65.95/bbl; prices have increased by $1.22/bbl in compared to last closing prices. While Brent on Inter

- Continental Exchange increased by $1.96/bbl in compare to last closing price and was assessed around $77.32/bbl.

- As per report, Crude prices got an early lift on concerns about exports from Venezuela. Gains grew while OPEC would focus on balancing the market rather than on rolling back production caps.

- The OPEC and other producers including Russia have cut output since 2017 to reduce a global crude glut. The group meets in Vienna on June 22 to discuss its supply policy. Market players said that to maintain the balance between supply and demand to ensure the stability of the oil markets matters to us

$1 = Rs. 67.50

Import Custom Ex. Rate USD/ INR: 67.85

Export Custom Ex. Rate USD/ INR: 66.15