MEG Weekly Report 07 Oct 2017

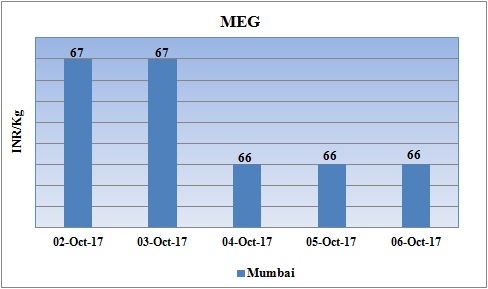

Weekly Price Trend: 02-10-2017 to 06-10-2017

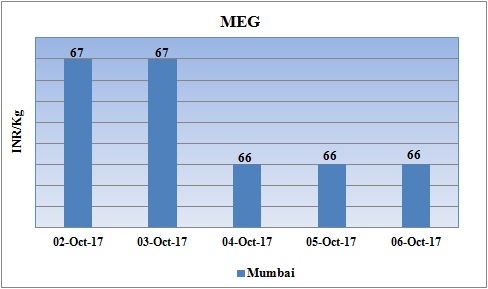

- The above given graph focuses on the MEG price trend from 2nd Oct to 6th Oct 2017.

- Prices have reduced slightly for this week. Domestic prices were assessed at the level of Rs.66/Kg for bulk quantity, lesser by Rs.1/Kg for bulk quantity in compare to last week’s closing values.

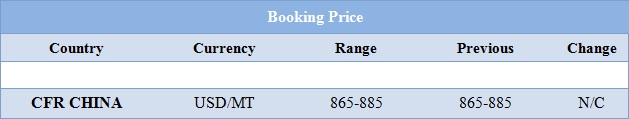

Booking Scenario

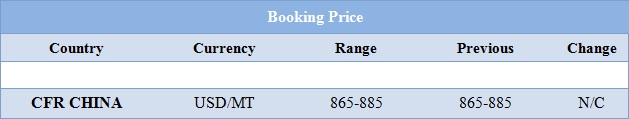

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices witnessed a decline in domestic values. Prices were assessed at the level of Rs.66/Kg for bulk quantity.

- CFR China values were assessed around USD 865-885/MT, with no change in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1345/MT while FOB Korea values were assessed around USD 1375/MT.

- Lowering of MEG values in China market has been particularly due to lower demand from the downstream industry. The major polyester industries will resume their production by end of September. This will boost demand in the later part of this year.

- Market sentiments remained stable as one of the major market of Asia, China remained closed due to golden week holidays. The Market will open now on Monday. So the demand remained lull from China.

- Crude price remained volatile throughout this week. On Wednesday after slipping a bit oil prices rose again on Thursday based on expectations that Saudi Arabia and Russia would extend production cuts, although record U.S. exports and the return of supply from a Libyan oilfield dragged on the market.

- On Thursday, crude values closed on higher note. WTI on NYME closed at $50.79/bbl, prices have increased by $0.81/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $1.20/bbl in compared to last trading and was assessed around $57.00/bbl.

- As per market players, OPEC and other producers, including Russia, to cut oil output to boost prices could be extended to the end of 2018, instead of expiring in March 2018.

$1 = Rs. 65.38

Import Custom Ex. Rate USD/ INR: 65.95

Export Custom Ex. Rate USD/ INR: 64.30