MEG Weekly Report 06 Oct 2018

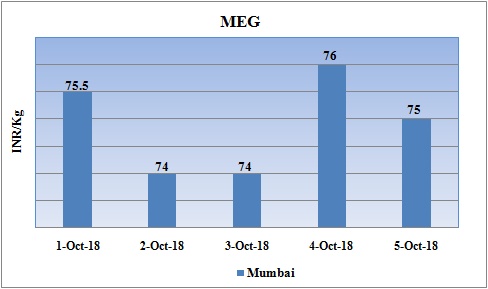

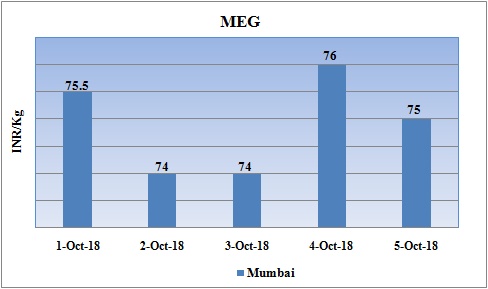

Weekly Price Trend: 01-10-2018 to 05-10-2018

- The above given graph focuses on the MEG price trend from 1st Oct to 5th Oct 2018.

- Domestic prices remained vulnerable and declined by end of the week. Domestic prices were assessed at the level of Rs.75/Kg for bulk quantity.

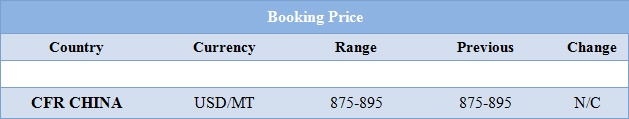

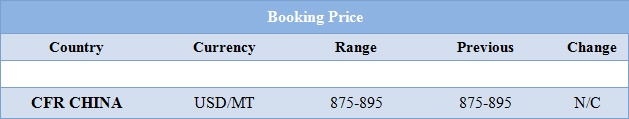

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained weak for bulk quantity. Prices were assessed at the level of Rs.75/Kg for bulk quantity.

- CFR China values were assessed around USD 875-895/MT, with no change for this week. CFR South East Asia assessed around USD 900/MT. CFR India price were assessed around USD 900/MT.

- FOB Korea values for Ethylene improved for this week and were assessed around USD 1215/MT, while CFR China values were assessed around USD 1205/MT and CFR South East Asia values were assessed around USD 1110/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1135/MT while CFR China values were assessed around USD 1170/MT.

- In compare to MEG values prices for Ethylene and Propylene has reduced heavily in the international market.

- Declining Indian currency is creating new records against dollar and is also one of the main reasons for rise in petrochemical prices.

- There has been heavy fluctuation in crude prices in this week. As the month of November is approaching fast the heat of sanction felt in the crude values across the world.

- On Thursday crude prices plunged due to rise in the inventory levels in US. But this hike was again pulled back on Thursday. Saudi Arabia and Russia has stated they will increase the crude supply but could not fill the void created by disruption of supply from Iran.

- With short supply from the price for crude is likely to reach a mark of $90 to $100 per barrel. On Wednesday, Saudi Energy Minister Khalid al-Falih said the kingdom was pumping near record levels and would raise output in November. Saudi Arabia is one of the few countries with the ability to significantly raise output. Many experts believe that the spar capacity of specified by Saudi is merely a statement but does exist in reality.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $74.33/bbl. Prices have decreased by $2.08/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.71/bbl in compare to last closing price and was assessed around $84.58/bbl.

$1 = Rs. 73.78

Import Custom Ex. Rate USD/ INR: 74.60

Export Custom Ex. Rate USD/ INR: 72.90