MEG Weekly Report 03 Feb 2018

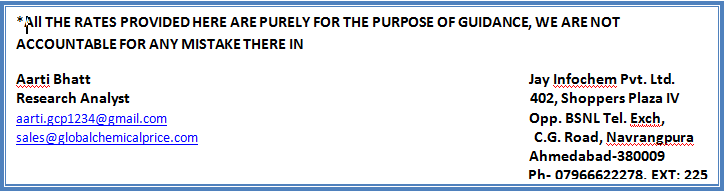

Weekly Price Trend: 29-01-2018 to 02-02-2018

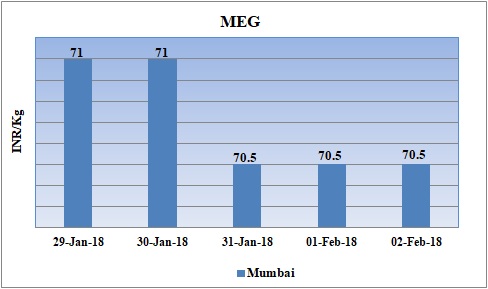

- The above given graph focuses on the MEG price trend from 29th Jan to 2nd Feb 2018.

- Prices reduced for this week on back of abundant supply in domestic market. Domestic prices were assessed at the level of Rs.70.5s/Kg for bulk quantity.

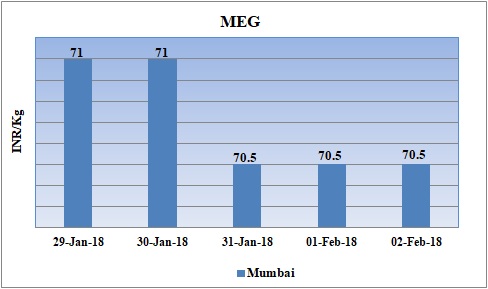

Booking Scenario

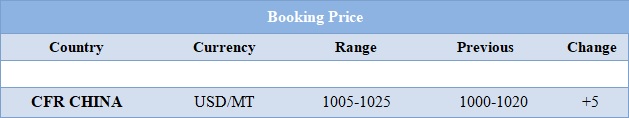

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained soft-to-stable for bulk quantity. Prices were assessed at the level of Rs.70.5/Kg for bulk quantity.

- CFR China values were assessed around USD 1005-1025MT, with an increase of USD 5/MTS in compare to last week’s assessed values.

- CFR South East Asia assessed around USD 1020/MT increased by USD5/MTS in compare to last week’s closing values.

- There was significant hike in MEG values last week as downstream product values were building new highs. As week proceeded the temporary hike began to settle down and prices reduced to firmness as prices for Ethylene also lessened.

- FOB Korea values for Ethylene were assessed around USD 1305/MT, reduced by USD 45/MTS while CFR China values were assessed around USD 1335/MT, reduced by USD 45/MTS in compare to last week’s closing values.

- Strong buying sentiments coupled with healthy demand has been dominating the Asian markets for price surge.

- Propylene market has also been witnessing firmness in prices. FOB Korea values were assessed around USD 1075/MT while CFR China values were assessed around USD 1145MT. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian markets.

- With announcement of budget 2018 on Thursday, the petrochemical sector of India has remained subdued. With upsurge in crude values in international market and increasing currency rate are symptoms for weak economic growth and slowdown in economic development.

- This week oil prices have followed volatile trend. Goldman Sachs on Thursday raised its 2018 oil price forecasts, projecting that Brent crude will soon top $80, fueled by blockbuster oil demand, a deal among big producers to limit output and U.S. drillers' inability to meet the world's growing energy appetite.

- On Thursday, closing crude values have increased. WTI on NYME closed at $65.80/bbl; prices have increased by $1.07/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.03/bbl in compared to last trading and was assessed around $69.08/bbl.

- On Friday oil prices showed strong compliance with output cuts by OPEC and others including Russia, offsetting concerns about surging U.S. production.

- Goldman recently raised its 2018 forecast for oil demand growth to 1.86 million barrels a day from 1.73 million barrels a day. it introduced its 2019 demand forecast at 1.6 million barrels a day but said economic growth around the world means consumption could be even stronger.

$1 = Rs. 64.06

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.85