EDC Weekly Report 29 Sep 2018

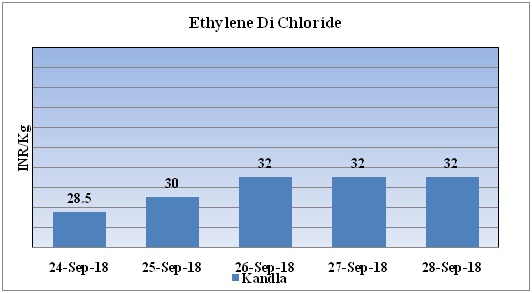

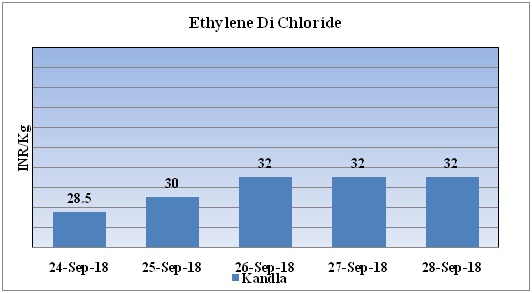

Weekly Price Trend: 24-09-2018 to 28-09-2018

- The above graph focuses on the weekly price trend of EDC for the current week.

- As per the above graph, it has been inferred that this week the prices of EDC have increased in compare to previous week and at the end of this week prices were assessed at the level of Rs 32/kg.

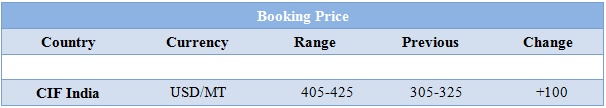

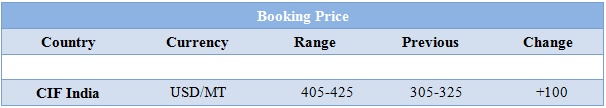

Booking Scenario

INDIA & INTERNATIONAL

- This week in the domestic market, prices of EDC have increased little in compare to previous week and were assessed at Rs 32/kg.

- In international market, prices of EDC also have increased in compare to earlier week.

- This week EDC prices have increased On bullish sentiments and increased in energy and feedstock prices.

- Asia’s petrochemical trades have slowed down as China will go on a week-long holiday in October.

- CFR North East Asia prices were assessed at the USD 1290/MT.

- FOB Korea prices of feedstock ethylene USD 1250/MT

- CFR China prices of feedstock ethylene USD 1290/MT

- CFR South East Asia prices of feedstock ethylene USD 1155/MT.

- Feedstock ethylene price rise on improved buying interest in the region due to higher upstream energy values.

- China's Secco will shut its steam cracker in Shanghai in October for annual maintenance, market sources said. It is having production capacity of 1.2 million mt/year of ethylene.

- Ethylene supply was also tighter due to the maintenance at the steam crackers, which are slated to resume production by end November. Market sources said spot ethylene demand in China was currently healthy due to positive margins for SM production at around $180/mt.

- Continuous surge in crude prices has heated the global oil market. Crude prices are likely to cross the mark of USD 100 in next few weeks.

- According to Petrochemical giant Total, the supply disruptions and the delay time associated with OPEC’s ability to increase production could pull up the price to $100 per barrel. This in turn will hamper the economy and the oil industry.

$1 = Rs. 72.48

Import Custom Ex. Rate USD/ INR: 73.65

Export Custom Ex. Rate USD/ INR: 71.95