EDC Weekly Report 22 Sep 2018

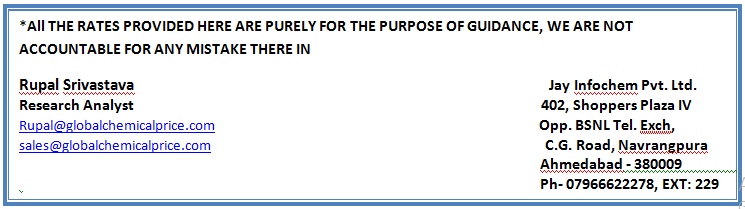

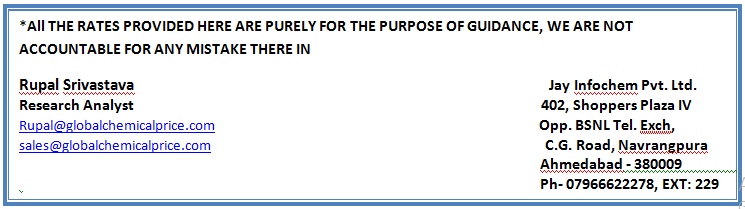

Weekly Price Trend: 17-09-2018 to 21-09-2018

- The above graph focuses on the weekly price trend of EDC for the current week.

- As per the above graph, it has been inferred that this week the prices of EDC have increased in compare to previous week and at the end of this week prices were assessed at the level of Rs 28/kg.

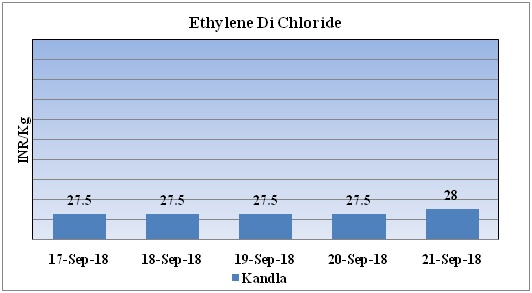

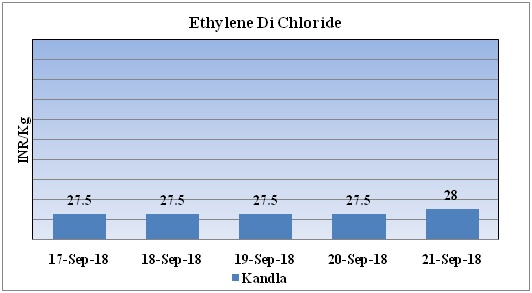

Total import at various ports of India August, 2018

Above graph represents the imported quantity of EDC for the month of August. Last month total imports were around 74177MT.

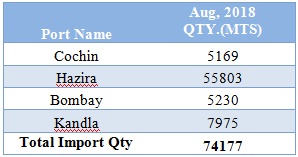

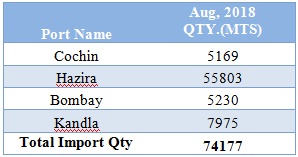

Booking Scenario

INDIA & INTERNATIONAL

- This week in the domestic market, prices of EDC have increased little in compare to previous week and were assessed at Rs 28/kg.

- In international market, prices of EDC also have remained firm in compare to earlier week.

- As per report, bearish buying sentiments and abundant product availability pressured prices of ethylene sharply lower in Asia.

- Ethylene is expected to remain stable in near term as market participants are waiting for a clearer price trend to emerge.

- CFR North East Asia prices were assessed at the USD 1265/MT.

- FOB Korea prices of feedstock ethylene USD 1270/MT

- CFR China prices of feedstock ethylene USD 1245/MT

- CFR South East Asia prices of feedstock ethylene USD 1125/MT.

- Prices for ethylene shipments into northeast Asia rose for the first time in five weeks as buyers in China replenished their stock.

- Thailand's PTTGC floats sales tender for H2 Oct ethylene shipment.

- Crude prices are making new heights. On Thursday prices slightly eased with US president urging OPEC to bring prices down. Experts believe that Brent will soon cross the mark of USD 80 after gap of four years. US President would least want the crude prices to go high with mid election in next few months.

- The Iranian sanctions are making hard for the Asian countries which are the consumers of Iranian crude. Many buyers have already cut Iranian purchases ahead of the new regulations. It is unclear whether producers such as Saudi Arabia, Iraq and Russia can compensate for lost supply.

- The Organization of the Petroleum Exporting Countries and other producers, including Russia, meet on Sunday in Algeria to discuss how to allocate supply increases to offset the loss of Iranian barrels.

$1 = Rs. 72.19

Import Custom Ex. Rate USD/ INR: 73.65

Export Custom Ex. Rate USD/ INR: 71.95