C9 Weekly Report 03 Feb 2018

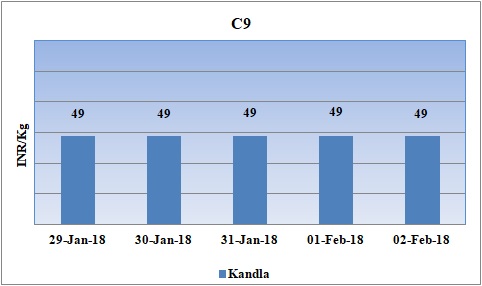

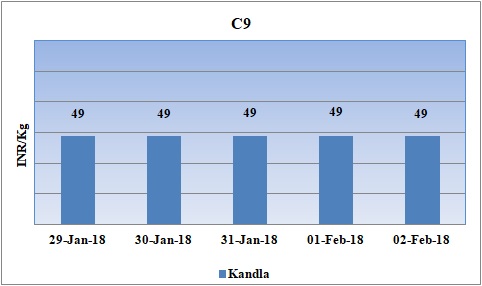

Weekly Price Trend: 29-01-2018 to 02-02-2018

- The above given graph focuses on the C9 price trend for the current week.

- Domestic prices of C9 remained stable to firm for this week. Prices were assessed at the level of Rs.49/Kg for bulk quantity by closing of market.

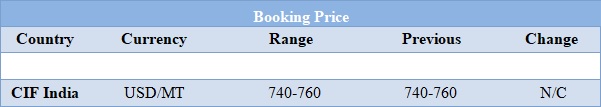

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices remained unchanged for this week. Prices were assessed at the level of Rs.49/Kg for bulk quantity.

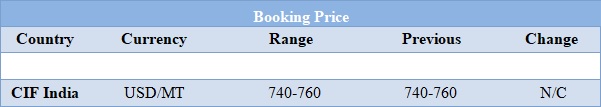

- Prices in international market remained soft-to-stable for this week. CIF India prices were assessed at the level of USD 740-760/MTS, with no change in compare to last week’s closing values.

- With announcement of budget 2018 on Thursday, the petrochemical sector of India has remained subdued. With upsurge in crude values in international market and increasing currency rate are symptoms for weak economic growth and slowdown in economic development.

- This week oil prices have followed volatile trend. Goldman Sachs on Thursday raised its 2018 oil price forecasts, projecting that Brent crude will soon top $80, fueled by blockbuster oil demand, a deal among big producers to limit output and U.S. drillers' inability to meet the world's growing energy appetite.

- On Thursday, closing crude values have increased. WTI on NYME closed at $65.80/bbl; prices have increased by $1.07/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.03/bbl in compared to last trading and was assessed around $69.08/bbl.

- On Friday oil prices showed strong compliance with output cuts by OPEC and others including Russia, offsetting concerns about surging U.S. production.

- Goldman recently raised its 2018 forecast for oil demand growth to 1.86 million barrels a day from 1.73 million barrels a day. it introduced its 2019 demand forecast at 1.6 million barrels a day but said economic growth around the world means consumption could be even stronger.

1$ = Rs. 64.06

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.85