Butyl Acrylate Monomer Weekly Report 05 Aug 2017

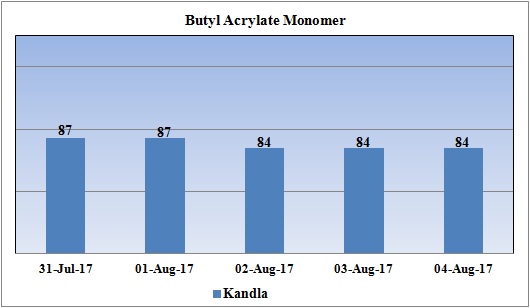

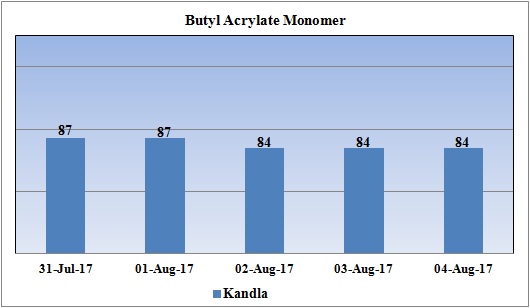

Weekly Price Trend: 31-07-2017 to 04-08-2017

- The above given graph focuses on the Butyl Acrylate Monomer price trend for current week.

- If we take a quick look at the above given weekly prices, it can be observed that prices reduced for this week.

- Prices of BAM were assessed at the level of Rs.84/Kg for ex Kandla for bulk quantity reduced by Rs.3/Kg for bulk quantity.

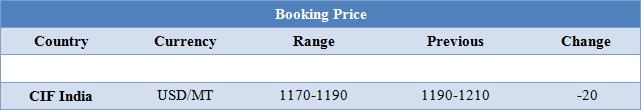

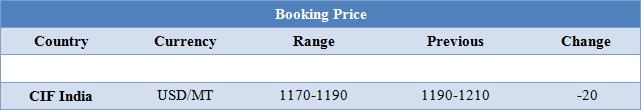

Booking Scenario

The above chart shows the international prices of BAM and its comparison from the previous prices. On Friday CFR India prices of BAM prices decreased heavily this week.

INDIA & INTERNATIONAL

- BAM prices declined in domestic market for this week. By end of this week prices were assessed at the level of Rs.84/Kg decreased Rs.3/Kg in compare to last week’s closing values.

- CIF India prices of BAM were assessed at the level of USD 1170-1190/MT (Full Duty), reduced by USD30/MT in compare to last week’s closing values. This has been due to mixed price trend in crude values in global market.

- This week prices followed mixed trend. On Thursday oil prices plunged as watchful buying dried up after U.S. crude rose to nearly $50 a barrel. On Thursday, WTI on NYME closed at $49.03/bbl, prices have decreased by $0.56/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.35/bbl in compared to last trading and was assessed around $52.01/bbl.

- Investors are looking forward for OPEC meeting which is to be held next week for fresh insight into the oil cartel's commitment to improve compliance with the deal to curb production.

- However, market participants downplayed the importance of the meeting to be held next week, suggesting oil prices may struggle to sustain the current rising trend.

- According to reports, there will be reluctance in production cuts or a sustained uptick in demand, prices are likely to remain in the low to mid $50s for the remainder of the year. There are signs that the oil industry has adapted to an era of low prices and can produce and operate at levels that would previously have been uneconomic.

1$ : Rs. 63.58

Import Custom Ex. Rate USD/ INR: 64.55

Export Custom Ex. Rate USD/ INR: 62.85