Butyl Acetate Weekly Report 29 Sep 2018

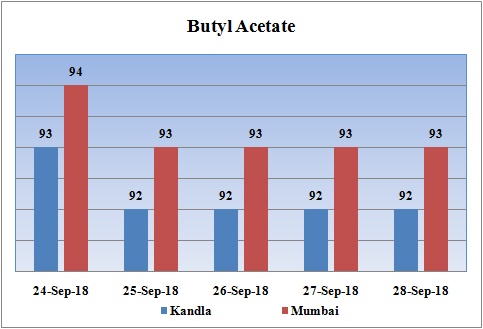

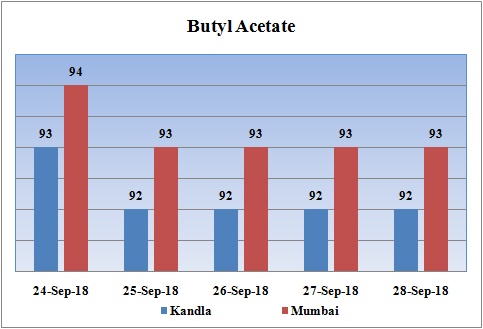

Weekly Price Trend: 24-09-2018 to 28-09-2018

- The above graph focuses on the weekly price trend of Butyl Acetate for the current week.

- Compares to previous week Butyl Acetate prices slightly reduced for this week.

- Butyl Acetate prices were assessed at the level of Rs.93/Kg for Mumbai and Rs.92/Kg for Kandla ports of India.

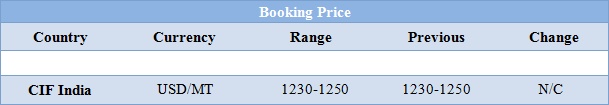

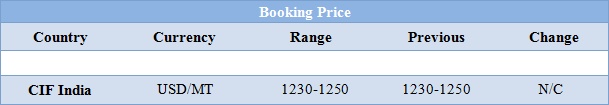

Booking Scenario

The above chart shows the international prices of Butyl Acetate and its comparison from the previous prices. These booking prices for CIF India are for 0% duty.

INDIA & INTERNATIONAL

- Butyl Acetate prices slightly reduced in domestic market. Prices were assessed at the level of Rs.93/Kg for Mumbai and for Rs.92/Kg Kandla port for bulk quantity.

- Prices in the international market remained firm with no change for this week. CIF India prices were assessed in the range of USD 1230-1250, stable in compare to last week’s

- China market will remain closed for next week as the nation will be celebrating Golden week festival.

- Continuous surge in crude prices has heated the global oil market. Crude prices are likely to cross the mark of USD 100 in next few weeks.

- According to Petrochemical giant Total, the supply disruptions and the delay time associated with OPEC’s ability to increase production could pull up the price to $100 per barrel. This in turn will hamper the economy and the oil industry.

- Disruptions in supply coming from Iran, Venezuela, and Libya give strong support to oil prices and they may head into triple-digit territory. On the other hand, although OPEC has assured to boost production, but output hasn’t increased so much. Saudi Arabia has capacity of 11 million bpd, but boosting production from current levels would need time, because they have to mobilize rigs.

- US Sanctions will surely trigger a dramatic shortfall in global supply. And the sanctions are widely expected to have an immediate impact on Iran's oil exports, although estimates of exactly how much of the country's oil could disappear from November 4 vary widely.

- Some energy market analysts expect around 500,000 barrels per day (bpd) to disappear once U.S. sanctions against Iran come into force, while others have warned as much as 2 million bpd could come offline over the coming months.

$1 = Rs. 72.48

Import Custom Ex. Rate USD/ INR: 73.65

Export Custom Ex. Rate USD/ INR: 71.95